Filed Pursuant to Rule 253(g)(1)

File No. 024-12042

OFFERING CIRCULAR

InnovaQor, Inc.

75,000,000 Shares of Common Stock

By this Offering Circular, InnovaQor, Inc., a Nevada corporation known as VisualMED Clinical Solutions Corp. in the public trading markets, is offering for sale a maximum of 75,000,000 shares of its common stock (the “Offered Shares”), at a fixed price of $0.005 per share, pursuant to Tier 2 of Regulation A of the United States Securities and Exchange Commission (the “SEC”). A minimum purchase of $5,000 of the Offered Shares is required in this offering; any additional purchase must be in an amount of at least $1,000. This offering is being conducted on a best-efforts basis, which means that there is no minimum number of Offered Shares that must be sold by us for this offering to close; thus, we may receive no or minimal proceeds from this offering. All proceeds from this offering will become immediately available to us and may be used as they are accepted. Purchasers of the Offered Shares will not be entitled to a refund and could lose their entire investments. Please see the “Risk Factors” section, beginning on page 5, for a discussion of the risks associated with a purchase of the Offered Shares.

We estimate that this offering will commence within two days of qualification; this offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering being qualified by the SEC or (c) the date on which this offering is earlier terminated by us, in our sole discretion. (See “Plan of Distribution”).

Title of Securities Offered | Number of Shares | Price to Public | Commissions (1) | Proceeds to Company (2) | ||||||||||||

| Common Stock | 75,000,000 | $ | 0.005 | $ | -0- | $ | 375,000 | |||||||||

| (1) | We may offer the Offered Shares through registered broker-dealers and we may pay finders. However, information as to any such broker-dealer or finder shall be disclosed in an amendment to this Offering Circular. | |

| (2) | Does not account for the payment of expenses of this offering estimated at $20,000. See “Plan of Distribution.” |

Our common stock is quoted in the over-the-counter under the symbol “VMCS” in the OTC Pink marketplace of OTC Link. On November 11, 2022, the closing price of our common stock was $0.0073 per share.

Investing in the Offered Shares is speculative and involves substantial risks, including the superior voting rights of our outstanding shares of Series A-1 Supermajority Voting Preferred Stock, which could have the effect of precluding current and future owners of our common stock, including the Offered Shares, from influencing any corporate decision. You should purchase Offered Shares only if you can afford a complete loss of your investment. See Risk Factors, beginning on page 5, for a discussion of certain risks that you should consider before purchasing any of the Offered Shares.

The Series A-1 Supermajority Voting Preferred Stock has the following voting rights: so long as one share of Series A-1 Supermajority Voting Preferred Stock is outstanding, the outstanding share(s) of the Series A-1 Supermajority Voting Preferred Stock shall have the number of votes, in the aggregate, equal to 51% of all votes entitled to be voted at any meeting of our shareholder meeting. The current owner of all outstanding shares of the Series A-1 Supermajority Voting Preferred Stock, Epizon Limited, will, therefore, be able to control the management and affairs of our company, as well as matters requiring the approval by our shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. (See “Risk Factors—Risks Related to a Purchase of the Offered Shares” and “Security Ownership of Certain Beneficial Owners and Management”).

THE SEC DOES NOT PASS UPON THE MERITS OF, OR GIVE ITS APPROVAL TO, ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SEC. HOWEVER, THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The use of projections or forecasts in this offering is prohibited. No person is permitted to make any oral or written predictions about the benefits you will receive from an investment in Offered Shares.

No sale may be made to you in this offering, if you do not satisfy the investor suitability standards described in this Offering Circular under “Plan of Distribution—State Law Exemption and Offerings to ‘Qualified Purchasers’” (page 19). Before making any representation that you satisfy the established investor suitability standards, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

This Offering Circular follows the disclosure format of Form S-1, pursuant to the General Instructions of Part II(a)(1)(ii) of Form 1-A.

The date of this Offering Circular is November 14, 2022.

TABLE OF CONTENTS

| 2 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this Offering Circular includes some statements that are not historical and that are considered forward-looking statements. Such forward-looking statements include, but are not limited to, statements regarding our development plans for our business; our strategies and business outlook; anticipated development of our company; and various other matters (including contingent liabilities and obligations and changes in accounting policies, standards and interpretations). These forward-looking statements express our expectations, hopes, beliefs and intentions regarding the future. In addition, without limiting the foregoing, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words anticipates, believes, continue, could, estimates, expects, intends, may, might, plans, possible, potential, predicts, projects, seeks, should, will, would and similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Offering Circular are based on current expectations and beliefs concerning future developments that are difficult to predict. We cannot guarantee future performance, or that future developments affecting our company will be as currently anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

All forward-looking statements attributable to us are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties, along with others, are also described below in the Risk Factors section. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

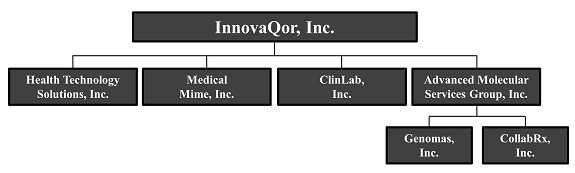

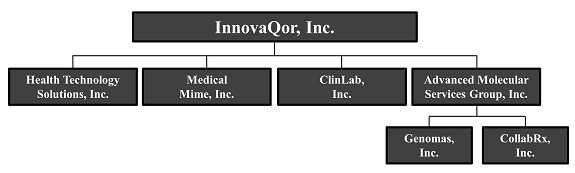

The following summary highlights material information contained in this Offering Circular. This summary does not contain all of the information you should consider before purchasing our common stock. Before making an investment decision, you should read this Offering Circular carefully, including the Risk Factors section and the consolidated financial statements and the notes thereto. Unless otherwise indicated, the terms “InnovaQor,” “the Company”, “we”, “us” and “our” refer and relate to InnovaQor, Inc., a Nevada corporation known as VisualMED Clinical Solutions Corp. in the public trading markets, including our subsidiaries: Health Technology Solutions, Inc., Medical Mime, Inc., ClinLab, Inc., Advanced Molecular Services Group, Inc., Genomas, Inc. and CollabRx, Inc.

| 3 |

Our Company

Our company, InnovaQor, Inc., a Nevada corporation, was originally incorporated in the State of Nevada on September 7, 1999, under the name Ancona Mining Corporation. On November 30, 2004, our corporate name changed to VisualMED Clinical Solutions Corporation (“VisualMED”). On September 8, 2021, our corporate name changed to InnovaQor, Inc. However, in the public trading markets, our company is still known as VisualMED Clinical Solutions Corporation. We have filed with FINRA to change our trading symbol.

The Company provides information technology solutions and services to healthcare and laboratory customers in the United States. Our goal is to develop and deliver a technology-based social media and communication platform to a broad range of healthcare professionals and businesses using a subscription revenue model with added value bolt on services. The Company, through an acquisition that closed on June 25, 2021, has a number of fully developed products and services which it offers through six wholly-owned subsidiaries that provide medical support services primarily to clinical laboratories, corporate operations, rural hospitals, physician practices and behavioral health/substance abuse centers.

Each of the subsidiaries is wholly owned by the Company and complements each other, allowing for cross selling of products and services. The Company believes the current solutions will become an added value option to a technology-based social media communication platform to a broad range of healthcare professionals and businesses using a subscription revenue model with added value bolt on services the Company plans to develop.

In the coming year we plan to develop, acquire or license and offer a telehealth solution through corporate partnerships in the emerging health technology sector. (See “Business”).

Offering Summary

| Securities Offered | The Offered Shares, 75,000,000 shares of common stock, are being offered by our company. | |

| Offering Price Per Share | $0.005 per Offered Share. | |

Shares Outstanding Before This Offering |

234,953,286 shares of common stock issued and outstanding as of the date of this Offering Circular. | |

Shares Outstanding After This Offering |

309,953,286 shares of common stock issued and outstanding, assuming a maximum offering hereunder. | |

Minimum Number of Shares to Be Sold in This Offering |

None | |

| Disparate Voting Rights | Our outstanding shares of Series A-1 Supermajority Voting Preferred Stock possess superior voting rights, which effectively preclude current and future owners of our common stock, including the Offered Shares, from influencing any corporate decision. The Series A-1 Supermajority Voting Preferred Stock has the following voting rights: so long as one share of Series A-1 Supermajority Voting Preferred Stock is outstanding, the outstanding share(s) of the Series A-1 Supermajority Voting Preferred Stock shall have the number of votes, in the aggregate, equal to 51% of all votes entitled to be voted at any meeting of our shareholder meeting. Epizon Limited (see Note 5 to the ownership table under “Security Ownership of Certain Beneficial Owners and Management” for information concerning beneficial ownership and control of Epizon Limited), as the current owner of all outstanding shares of the Series A-1 Supermajority Voting Preferred Stock, will, therefore, be able to control the management and affairs of our company, as well as matters requiring the approval by our shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. (See “Risk Factors—Risks Related to a Purchase of the Offered Shares”). | |

| Investor Suitability Standards | The Offered Shares are being offered and sold only to “qualified purchasers” (as defined in Regulation A under the Securities Act). “Qualified purchasers” include: (a) “accredited investors” under Rule 501(a) of Regulation D and (b) all other investors so long as their investment in the Offered Shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). | |

| Market for our Common Stock | Our common stock is quoted in the over-the-counter market under the symbol “VMCS” in the OTC Pink marketplace of OTC Link. | |

| Termination of this Offering | This offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering being qualified by the SEC and (c) the date on which this offering is earlier terminated by us, in our sole discretion. (See “Plan of Distribution”). |

| 4 |

| Use of Proceeds | We will apply the proceeds of this offering for current liabilities, existing product updates, sales and marketing, ongoing operations and new platform development. (See “Use of Proceeds”). | |

| Risk Factors | An investment in the Offered Shares involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investments. You should carefully consider the information included in the Risk Factors section of this Offering Circular, as well as the other information contained in this Offering Circular, prior to making an investment decision regarding the Offered Shares. | |

| Corporate Information | Our principal executive offices are located at 400 South Australian Avenue, Suite 800, West Palm Beach, Florida 33401; our telephone number is (561) 421-1900; our corporate website is located at www.innovaqor.com. No information found on our company’s website is part of this Offering Circular. |

Continuing Reporting Requirements Under Regulation A

We are required to file periodic and other reports with the SEC, pursuant to the requirements of Section 13(a) of the Securities Exchange Act of 1934. Our continuing reporting obligations under Regulation A are deemed to be satisfied, as long as we comply with our Section 13(a) reporting requirements. As a Tier 2 issuer under Regulation A, we will be required to file with the SEC a Form 1-Z (Exit Report Under Regulation A) upon the termination of this offering.

An investment in the Offered Shares involves substantial risks. You should carefully consider the following risk factors, in addition to the other information contained in this Offering Circular before purchasing any of the Offered Shares. The occurrence of any of the following risks might cause you to lose a significant part of your investment. The risks and uncertainties discussed below are not the only ones we face, but do represent those risks and uncertainties that we believe are most significant to our business, operating results, prospects and financial condition. Some statements in this Offering Circular, including statements in the following risk factors, constitute forward-looking statements. (See “Cautionary Statement Regarding Forward-Looking Statements”).

Going Concern Risk Factor

Although our financial statements have been prepared on a going concern basis, we have accumulated significant losses and have negative cash flows from operations that could adversely affect our ability to secure additional capital to fund our operations or limit our ability to react to changes in the economy or our industry. These or additional risks or uncertainties not presently known to us, or that we currently deem immaterial, raise substantial doubt about our ability to continue as a going concern. Under Accounting Standards Update (“ASU”) 2014-15, Presentation of Financial Statements—Going Concern (Subtopic 205-40) Accounting Standards Codification (“ASC 205-40”), InnovaQor has the responsibility to evaluate whether conditions and/or events raise substantial doubt about its ability to meet its future financial obligations as they become due within one year after the date that the financial statements are issued. As required by ASC 205-40, this evaluation shall initially not take into consideration the potential mitigating effects of plans that have not been fully implemented as of the date the financial statements are issued. Management has assessed InnovaQor’s ability to continue as a going concern in accordance with the requirement of ASC 205-40.

The accompanying consolidated financial statements have been prepared in accordance with U.S. GAAP and the rules and regulations of the SEC. The consolidated financial statements have been prepared using U.S. GAAP applicable to a going concern that contemplates the realization of assets and liquidation of liabilities in the normal course of business. InnovaQor has accumulated significant losses and has negative cash flows from operations. For the six months ended June 30, 2022, we incurred a net loss of $606,510 (unaudited) and, as of that date, we had an accumulated deficit of $18,616,660 (unaudited). For the years ended December 31, 2021 and 2020, we incurred a net loss of $845,843 and $606,451, respectively, and, as of such dates, we had an accumulated deficit of $18,010,150 and $-0-, respectively.

Additionally, we had net cash used in operating activities of $512,491 (unaudited) and $478,869 for the six months ended June 30, 2022, and the year ended December 31, 2021, respectively. At June 30, 2022, we had a working capital deficit of $3,451,460 (unaudited) and a shareholders’ deficit of $12,735,507 (unaudited). At December 31, 2021, we had a working capital deficit of $2,860,200 and a shareholders’ deficit of $12,128,997. Any losses in the future could cause the quoted price of our common stock to decline or have a material adverse effect on our financial condition, our ability to pay our debts as they become due, and on our cash flows.

Further, the Company’s cash position is critically deficient and critical payments are not being made in the ordinary course of business, all of which raises substantial doubt about InnovaQor’s ability to continue as a going concern. Management’s plans with respect to alleviating the adverse financial conditions that caused management to express substantial doubt about InnovaQor’s ability to continue as a going concern are discussed in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section.

| 5 |

InnovaQor has incurred substantial costs in connection with the acquisition of the Group which may include accounting, tax, legal and other professional services costs, recruiting and relocation costs associated with hiring key senior management personnel who are new to InnovaQor, tax costs and costs to separate information systems, among other costs. The cost of performing such functions is anticipated to be higher than the amounts reflected in InnovaQor’s historical financial statements, which would cause its future losses to increase. Accordingly, InnovaQor will continue to focus on increasing revenues.

There can be no assurance that InnovaQor will be able to achieve its business plan, raise any additional capital or secure the additional financing necessary to implement its current operating plan. The ability of InnovaQor to continue as a going concern is dependent upon its ability to significantly increase its revenues and eventually achieve profitable operations. The accompanying consolidated financial statements do not include any adjustments that might be necessary if InnovaQor is unable to continue as a going concern.

General Business and Industry Risks

An inability to retain our senior management team would be detrimental to the success of our business. We rely heavily on our senior management team; our ability to retain them is particularly important to our future success. Given the highly specialized nature of our services (Healthcare, IT), the senior management team must have a thorough understanding of our product and service offerings as well as the skills and experience necessary to manage an organization consisting of a diverse group of professionals and external parties. In addition, we rely on our senior management team to generate and market our business successfully in a crowded, complex and legislatively bound marketplace. Further, our senior management’s personal reputations and relationships with our clients are a critical element in obtaining and maintaining client engagements. We will enter into non-solicitation agreements with our senior management team, and we will also enter into well scoped non-competition agreements. If one or more members of our senior management team leave and we cannot replace them with a suitable candidate quickly, we could experience difficulty in securing and successfully completing engagements and managing our business properly, which could harm our business prospects and results of operations.

Our inability to hire and retain talented people in an industry where there is great competition for talent could have a serious negative effect on our prospects and results of operations. Our business involves the delivery of software products and professional services and is labor intensive. Our success depends largely on our general ability to attract, develop, motivate, and retain highly skilled professionals. Further, we must successfully maintain the right mix of professionals with relevant experience and skill sets as we grow, as we expand into new service offerings, and as the market evolves. The loss of a significant number of our professionals, the inability to attract, hire, develop, train, and retain additional skilled personnel, or failure to maintain the right mix of professionals could have a serious negative effect on us, including our ability to manage, staff, and successfully complete our existing engagements and obtain new engagements. Qualified professionals are in great demand, and we face significant competition for both senior and junior professionals with the requisite credentials and experience. Our principal competition for talent comes from other software and consulting firms as well as from organizations seeking to staff their internal professional positions. Many of these competitors may be able to offer significantly greater compensation and benefits or more attractive lifestyle choices, career paths, or geographic locations than we do. Therefore, we may not be successful in attracting and retaining the skilled persons we require to conduct and expand our operations successfully. Increasing competition for these revenue-generating professionals may also significantly increase our labor costs, which could negatively affect our margins and results of operations.

Additional hiring, departures, business acquisitions and dispositions could disrupt our operations, increase our costs or otherwise harm our business. Our business strategy is dependent in part upon our ability to grow by hiring individuals or groups of individuals and by acquiring complementary businesses. However, we may be unable to identify, hire, acquire, or successfully integrate new employees and acquired businesses without substantial expense, delay, or other operational or financial obstacles. From time to time, we will evaluate the total mix of products and services we provide and we may conclude that businesses may not achieve the results we previously expected. Competition for future hiring and acquisition opportunities in our markets could increase the compensation we offer to potential employees or the prices we pay for businesses we wish to acquire. In addition, we may be unable to achieve the financial, operational, and other benefits we anticipate from any hiring or acquisition, as well as any disposition, including those we have completed so far. New acquisitions could also negatively impact existing practices and cause current employees to depart. Hiring additional employees or acquiring businesses could also involve a number of additional risks, including:

| ● | the diversion of management’s time, attention, and resources from managing and marketing our Company; | |

| ● | the failure to retain key acquired personnel or existing personnel who may view the acquisition unfavorably; | |

| ● | the potential loss of clients of acquired businesses; | |

| ● | the need to compensate new employees while they wait for their restrictive covenants with other institutions to expire; | |

| ● | the potential need to raise significant amounts of capital to finance a transaction or the potential issuance of equity securities that could be dilutive to our existing shareholders; | |

| ● | increased costs to improve, coordinate, or integrate managerial, operational, financial, and administrative systems; | |

| ● | the potential assumption of liabilities of an acquired business; | |

| ● | the inability to attain the expected synergies with an acquired business; |

| 6 |

| ● | the usage of earn-outs based on the future performance of our business acquisitions may deter the acquired company from fully integrating into our existing business; | |

| ● | the perception of inequalities if different groups of employees are eligible for different benefits and incentives or are subject to different policies and programs; and | |

| ● | difficulties in integrating diverse backgrounds and experiences of consultants, including if we experience a transition period for newly hired consultants that results in a temporary drop in our utilization rates or margins. |

Our intangible assets primarily consist of customer relationships, trade names, customer contracts, technology and software. We evaluate our intangible assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be recoverable. No impairment charges for intangible assets were recorded in the year ended December 31, 2021, or the six months ended June 30, 2022.

Determining the fair value of a reporting unit requires us to make significant judgments, estimates, and assumptions. While we believe that the estimates and assumptions underlying our valuation methodology are reasonable, these estimates and assumptions could have a significant impact on whether or not a non-cash goodwill impairment charge is recognized and also the magnitude of any such charge. The results of an impairment analysis are as of a point in time. There is no assurance that the actual future earnings or cash flows of our reporting units will be consistent with our projections. We will monitor any changes to our assumptions and will evaluate goodwill as deemed warranted during future periods. Any significant decline in our operations could result in additional non-cash goodwill impairment charges.

Changes in capital markets, legal or regulatory requirements, and general economic or other factors beyond our control could reduce demand for our services, in which case our revenues and profitability could decline. A number of factors outside of our control affect demand for our services. These include:

| ● | fluctuations in the U.S. economy; | |

| ● | the U.S. or global financial markets and the availability, costs, and terms of credit; | |

| ● | changes in laws and regulations; and | |

| ● | other economic factors and general business conditions. |

We are not able to predict the positive or negative effects that future events or changes to the U.S. economy, financial markets, or regulatory and business environment could have on our operations.

Changes in U.S. tax laws could have a material adverse effect on our business, cash flow, results of operations and financial conditions. We are subject to income and other taxes in the U.S. at the state and federal level. Changes in applicable U.S. state or federal tax laws and regulations, or their interpretation and application, could materially affect our tax expense and profitability. The Company has not filed its federal tax returns for the last 10 years. The Company does not anticipate material adjustments of its tax liabilities when such returns are filed, but there is no guarantee that such filings will not have a material adverse effect.

Acquisition of the HTS Group will present management with new challenges that did not exist under the umbrella of its former parent. Under the former parent, management had the support of an experienced financial team, HR support and support for SEC filings. This support system does not currently exist in the current company and new challenges are presenting themselves every day. The immature knowledge and experience in these areas are likely to take longer to complete actions and will take management’s attention away from the day to day operations where it is needed to improve revenues.

If we are unable to manage fluctuations in our business successfully, we may not be able to achieve profitability. To successfully manage growth, we must periodically adjust and strengthen our operating, financial, accounting, and other systems, procedures, and controls, which could increase our costs and may adversely affect our gross profits and our ability to achieve profitability if we do not generate increased revenues to offset the costs. As a public company, our information and control systems must enable us to prepare accurate and timely financial information and other required disclosures. If we discover deficiencies in our existing information and control systems that impede our ability to satisfy our reporting requirements, we must successfully implement improvements to those systems in an efficient and timely manner.

The nature of our services and the general economic environment make it difficult to predict our future operating results. To achieve profitability, we must:

| ● | attract, integrate, retain, and motivate highly qualified professionals; | |

| ● | achieve and maintain adequate utilization and suitable billing rates for our revenue-generating professionals; | |

| ● | expand our existing relationships with our clients and identify new clients in need of our services; | |

| ● | successfully resell product/ engagements and secure new client sales/engagements every year; |

| 7 |

| ● | maintain and enhance our brand recognition; and | |

| ● | adapt quickly to meet changes in our markets, our business mix, the economic environment, the credit markets, and competitive developments. |

Our financial results could suffer if we are unable to achieve or maintain adequate utilization and suitable billing rates for our products and services. Our profitability depends to a large extent on the utilization and billing rates of our professionals. Utilization of our professionals is affected by a number of factors, including:

| ● | the number and size of client sales/ engagements; | |

| ● | the timing of the commencement, completion and termination of engagements, which in many cases is unpredictable; | |

| ● | our ability to transition our consultants efficiently from completed engagements to new engagements; | |

| ● | the hiring of additional consultants because there is generally a transition period for new consultants that results in a temporary drop in our utilization rate; | |

| ● | unanticipated changes in the scope of client engagements; | |

| ● | our ability to forecast demand for our services and thereby maintain an appropriate level of consultants; and | |

| ● | conditions affecting the industries in which we practice as well as general economic conditions. |

The billing rates of our consultants that we are able to charge are also affected by a number of factors, including:

| ● | our clients’ perception of our ability to add value through our products/services; | |

| ● | the market demand for the products/services we provide; | |

| ● | an increase in the number of sales/engagements in the government sector, which are subject to federal contracting regulations; | |

| ● | introduction of new product/services by us or our competitors; | |

| ● | our competition and the pricing policies of our competitors; and | |

| ● | current economic conditions. |

If we are unable to achieve and maintain adequate overall utilization as well as maintain or increase the billing rates for our consultants, our financial results could materially suffer. In addition, our consultants may need to perform services at the physical locations of our clients. If there are natural disasters, disruptions to travel and transportation or problems with communications systems, our ability to perform services for, and interact with, our clients at their physical locations may be negatively impacted which could have an adverse effect on our business and results of operations.

It is likely that our quarterly results of operations may fluctuate in the future as a result of certain factors, some of which may be outside of our control. A key element of our strategy is to market our products and services directly to certain specific organizations, such as health systems and hospitals, and to increase the number of our products and services utilized by existing clients. The sales cycle for some of our products and services is often lengthy and may involve significant commitment of client personnel. As a consequence, the commencement date of a client engagement often cannot be accurately forecasted. Certain of our client contracts contain terms that result in revenue that is deferred and cannot be recognized until the occurrence of certain events. As a result, the period of time between contract signing and recognition of associated revenue may be lengthy, and we are not able to predict with certainty the period in which revenue will be recognized.

Certain of our contracts provide that some portion or all of our fees are at risk if our services do not result in the achievement of certain performance targets. To the extent that any revenue is contingent upon the achievement of a performance target, we only recognize revenue upon client confirmation that the performance targets have been achieved. If a client fails to provide such confirmation in a timely manner, our ability to recognize revenue will be delayed.

Fee discounts, pressure to not increase or even decrease our rates, and less advantageous contract terms could result in the loss of clients, lower revenues and operating income, higher costs, and less profitable engagements. More discounts or write-offs than we expect in any period would have a negative impact on our results of operations.

Other fluctuations in our quarterly results of operations may be due to a number of other factors, some of which are not within our control, including:

| ● | the timing and volume of client invoices processed and payments received, which may affect the fees payable to us under certain of our engagements; | |

| ● | client decisions regarding renewal or termination of their contracts; | |

| ● | the amount and timing of costs related to the development or acquisition of technologies or businesses; and | |

| ● | unforeseen legal expenses, including litigation and other settlement gains or losses. |

| 8 |

The profitability of our fixed-fee engagements with clients may not meet our expectations if we underestimate the cost of these engagements. When making proposals for fixed-fee engagements, we estimate the costs and timing for completing the engagements. These estimates reflect our best judgment regarding the efficiencies of our methodologies and consultants as we plan to deploy them on engagements. Any increased or unexpected costs or unanticipated delays in connection with the performance of fixed-fee engagements, including delays caused by factors outside our control, could make these contracts less profitable or unprofitable, which would have an adverse effect on our profit margin.

Our business is becoming increasingly dependent on information technology and will require additional investments in order to grow and meet the demands of our clients. We depend on the use of sophisticated technologies and systems. Some of services may become dependent on the use of software applications and systems that we do not own and could become unavailable. Moreover, our technology platforms will require continuing investments by us in order to expand existing service offerings and develop complementary services. Our future success depends on our ability to adapt our services and infrastructure while continuing to improve the performance, features, and reliability of our services in response to the evolving demands of the marketplace.

Adverse changes to our relationships with key third-party vendors, or in the business of our key third-party vendors, could unfavorably impact our business. A portion of our services and solutions depends on technology or software provided by third-party vendors. Some of these third-party vendors refer potential clients to us, and others require that we obtain their permission prior to accessing their software. These third-party vendors could terminate their relationship with us without cause and with little or no notice, which could limit our service offerings and harm our financial condition and operating results. In addition, if a third-party vendor’s business changes or is reduced, that could adversely affect our business. Moreover, if third-party technology or software that is important to our business does not continue to be available or utilized within the marketplace, or if the services that we provide to clients is no longer relevant in the marketplace, our business may be unfavorably impacted.

We could experience system failures, service interruptions, or security breaches that could negatively impact our business. Our organization is comprised of employees who work on matters throughout the United States. We may be subject to disruption to our operating systems from technology events that are beyond our control, including the possibility of failures at third-party data centers, disruptions to the Internet, natural disasters, power losses, and malicious attacks. In addition, despite the implementation of security measures, our infrastructure and operating systems, including the Internet and related systems, may be vulnerable to physical break-ins, hackers, improper employee or contractor access, computer viruses, programming errors, denial-of-service attacks, or other attacks by third parties seeking to disrupt operations or misappropriate information or similar physical or electronic breaches of security. While we have taken and are taking reasonable steps to prevent and mitigate the damage of such events, including implementation of system security measures, information backup, and disaster recovery processes, those steps may not be effective and there can be no assurance that any such steps can be effective against all possible risks. We will need to continue to invest in technology in order to achieve redundancies necessary to prevent service interruptions. Access to our systems as a result of a security breach, the failure of our systems, or the loss of data could result in legal claims or proceedings, liability, or regulatory penalties and disrupt operations, which could adversely affect our business and financial results.

Our reputation could be damaged and we could incur additional liabilities if we fail to protect client and employee data through our own accord or if our information systems are breached. We rely on information technology systems to process, transmit, and store electronic information and to communicate among our locations and with our clients, partners, and employees. The breadth and complexity of this infrastructure increases the potential risk of security breaches which could lead to potential unauthorized disclosure of confidential information.

In providing services to clients, we may manage, utilize, and store sensitive or confidential client or employee data, including personal data and protected health information. As a result, we are subject to numerous laws and regulations designed to protect this information, such as the U.S. federal and state laws governing the protection of health or other personally identifiable information, including the Health Insurance Portability and Accountability Act (HIPAA). In addition, many states, and U.S. federal governmental authorities have adopted, proposed or are considering adopting or proposing, additional data security and/or data privacy statutes or regulations. Continued governmental focus on data security and privacy may lead to additional legislative and regulatory action, which could increase the complexity of doing business. The increased emphasis on information security and the requirements to comply with applicable U.S. data security and privacy laws and regulations may increase our costs of doing business and negatively impact our results of operations.

These laws and regulations are increasing in complexity and number. If any person, including any of our employees, negligently disregards or intentionally breaches our established controls with respect to client or employee data, or otherwise mismanages or misappropriates that data, we could be subject to significant monetary damages, regulatory enforcement actions, fines, and/or criminal prosecution.

In addition, unauthorized disclosure of sensitive or confidential client or employee data, whether through systems failure, employee negligence, fraud, or misappropriation, could damage our reputation and cause us to lose clients and their related revenue in the future.

| 9 |

Changes in capital markets, legal or regulatory requirements, general economic conditions and monetary or geo-political disruptions, as well as other factors beyond our control, could reduce demand for our practice offerings or services, in which case our revenues and profitability could decline. Different factors outside of our control could affect demand for our practices and our services. These include:

| ● | fluctuations in the U.S. economy, including economic recessions and the strength and rate of any general economic recoveries; | |

| ● | the U.S. financial markets and the availability, costs and terms of credit and credit modifications; | |

| ● | business and management crises, including the occurrence of alleged fraudulent or illegal activities and practices; | |

| ● | new and complex laws and regulations, repeals of existing laws and regulations or changes of enforcement of laws, rules and regulations; | |

| ● | other economic, geographic or political factors; and | |

| ● | general business conditions. |

We are not able to predict the positive or negative effects that future events or changes to the U.S. economy will have on our business. Fluctuations, changes and disruptions in financial, credit, mergers and acquisitions and other markets, political instability and general business factors could impact various segments’ operations and could affect such operations differently. Changes to factors described above, as well as other events, including by way of example, contractions of regional economies, monetary systems, banking, real estate and retail or other industries; debt or credit difficulties or defaults by businesses; new, repeals of or changes to laws and regulations, including changes to the bankruptcy and competition laws of the U.S.; tort reform; banking reform; a decline in the implementation or adoption of new laws of regulation, or in government enforcement, litigation or monetary damages or remedies that are sought; or political instability may have adverse effects on our business.

Our revenues, operating income and cash flows are likely to fluctuate. We expect to experience fluctuations in our revenues and cost structure and the resulting operating income and cash flows. We may experience fluctuations in our annual and quarterly financial results, including revenues, operating income and earnings per share, for reasons that include (i) the types and complexity, number, size, timing and duration of client engagements; (ii) the timing of revenue recognition under U.S. GAAP; (iii) the utilization of revenue-generating professionals, including the ability to adjust staffing levels up or down to accommodate our business and prospects of; (iv) the time it takes before a new hire becomes profitable; (v) the geographic locations of our clients or the locations where services are rendered; (vi) billing rates and fee arrangements, including the opportunity and ability to successfully reach milestones and complete projects, and collect for them; (vii) the length of billing and collection cycles and changes in amounts that may become uncollectible; (viii) changes in the frequency and complexity of government regulatory and enforcement activities; and (ix) economic factors beyond our control.

We may also experience fluctuations in our operating income and related cash flows because of increases in employee compensation, including changes to our incentive compensation structure and the timing of incentive payments. Also, the timing of investments or acquisitions and the cost of integrating them may cause fluctuations in our financial results, including operating income and cash flows. This volatility may make it difficult to forecast our future results with precision and to assess accurately whether increases or decreases in any one or more quarters are likely to cause annual results to exceed or fall short of expectations.

If we do not effectively manage the utilization of our professionals or billable rates, our financial results could decline. Our failure to manage the utilization of our professionals who bill on an hourly basis, or maintain or increase the hourly rates we charge our clients for our services, could result in adverse consequences, such as non- or lower-revenue-generating professionals, increased employee turnover, fixed compensation expenses in periods of declining revenues, the inability to appropriately staff engagements (including adding or reducing staff during periods of increased or decreased demand for our services), or special charges associated with reductions in staff or operations. Reductions in workforce or increases of billable rates will not necessarily lead to savings. In such events, our financial results may decline or be adversely impacted. A number of factors affect the utilization of our professionals. Some of these factors we cannot predict with certainty, including general economic and financial market conditions; the complexity, number, type, size and timing of client engagements; the level of demand for our services; appropriate professional staffing levels, in light of changing client demands and market conditions; and competition and acquisitions. In addition, any expansion into or within locations where we are not well-known or where demand for our services is not well-developed could also contribute to low or lower utilization rates.

InnovaQor may enter into engagements which involve non-time and material arrangements, such as fixed fees and time and materials with caps. Failure to effectively manage professional hours and other aspects of alternative fee engagements may result in the costs of providing such services exceeding the fees collected by InnovaQor. Failure to successfully complete or reach milestones with respect to contingent fee or success fee assignments may also lead to lower revenues or the costs of providing services under those types of arrangements may exceed the fees collected by InnovaQor.

| 10 |

We may receive requests to discount our fees or to negotiate lower rates for our services and to agree to contract terms relative to the scope of services and other terms that may limit the size of an engagement or our ability to pass through costs. We will consider these requests on a case-by-case basis. In addition, our clients and prospective clients may not accept rate increases that we put into effect or plan to implement in the future. Fee discounts, pressure not to increase or even decrease our rates, and less advantageous contract terms could result in the loss of clients, lower revenues and operating income, higher costs and less profitable engagements. More discounts or write-offs than we expect in any period would have a negative impact on our results of operations. There is no assurance that significant client engagements will be renewed or replaced in a timely manner or at all, or that they will generate the same volume of work or revenues, or be as profitable as past engagements.

Our Company faces certain risks, including (i) industry consolidation and a heightened competitive environment, (ii) downward pricing pressure, (iii) technology changes and obsolescence, (v) failure to protect client information against cyber-attacks and (vi) failure to protect IP, which individually or together could cause the financial results and prospects of the Company to decline. Our Company is facing significant competition from other consulting and/or software providers. There continues to be significant consolidation of companies providing products and services similar to those offered by our Company, which may provide competitors access to greater financial and other resources than those of InnovaQor. This industry is subject to significant and rapid innovation. Larger competitors may be able to invest more in research and development, react more quickly to new regulatory or legal requirements and other changes, or innovate more quickly and efficiently. Our Medical Mime and ClinLab software has been facing significant competition from competing software products.

The software and products of our Company are subject to rapid technological innovation. There is no assurance that we will successfully develop new versions of our Medical Mime and ClinLab software or other products. Our software may not keep pace with necessary changes and innovation. There is no assurance that new, innovative or improved software or products will be developed, compete effectively with the software and technology developed and offered by competitors, be price competitive with other companies providing similar software or products, or be accepted by our clients or the marketplace. If InnovaQor is unable to develop and offer competitive software and products or is otherwise unable to capitalize on market opportunities, the impact could adversely affect our operating margins and financial results.

Our reputation for providing secure information storage and maintaining the confidentiality of proprietary, confidential and trade secret information is critical to the success of our Company, which hosts client information as a service. We may face cyber-based attacks and attempts by hackers and similar unauthorized users to gain access to or corrupt our information technology systems. Such attacks could disrupt our business operations, cause us to incur unanticipated losses or expenses, and result in unauthorized disclosures of confidential or proprietary information. Although we seek to prevent, detect and investigate these network security incidents, and have taken steps to mitigate the likelihood of network security breaches, there can be no assurance that attacks by unauthorized users will not be attempted in the future or that our security measures will be effective.

We rely on a combination of copyrights, trademarks, trade secrets, confidentiality and other contractual provisions to protect our assets. Our software and related documentation will be protected principally under trade secret and copyright laws, which afford only limited protection, and the laws of some foreign jurisdictions provide less protection for our proprietary rights than the laws of the U.S. Unauthorized use and misuse of our IP by employees or third parties could have a material adverse effect on our business, financial condition and results of operations. The available legal remedies for unauthorized or misuse of our IP may not adequately compensate us for the damages caused by unauthorized use.

If we (i) fail to compete effectively, including by offering our software and services at a competitive price, (ii) are unable to keep pace with industry innovation and user requirements, (iii) are unable to replace clients or revenues as engagements end or are canceled or the scope of engagements are curtailed, or (iv) are unable to protect our clients’ or our own IP and proprietary information, the financial results of InnovaQor would be adversely affected. There is no assurance that we can replace clients or the revenues from engagements, eliminate the costs associated with those engagements, find other engagements to utilize our professionals, develop competitive products or services that will be accepted or preferred by users, offer our products and services at competitive prices, or continue to maintain the confidentiality of our IP and the information of our clients.

We may not manage our growth effectively, and our profitability may suffer. Periods of expansion may strain our management team, or human resources and information systems. To manage growth successfully, we may need to add qualified managers and employees and periodically update our operating, financial and other systems, as well as our internal procedures and controls. We also must effectively motivate, train and manage a larger professional staff. If we fail to add or retain qualified managers, employees and contractors when needed, estimate costs, or manage our growth effectively, our business, financial results and financial condition may suffer.

We cannot assure that we can successfully manage growth through acquisitions and the integration of the companies and assets we acquire or that they will result in the financial, operational and other benefits that we anticipate. Some acquisitions may not be immediately accretive to earnings, and some expansion may result in significant expenditures.

| 11 |

In periods of declining growth, underutilized employees and contractors may result in expenses and costs being a greater percentage of revenues. In such situations, we will have to weigh the benefits of decreasing our workforce or limiting our service offerings and saving costs against the detriment that InnovaQor could experience from losing valued professionals and their industry expertise and clients.

Our business, financial condition, results of operations and growth could be harmed by the effects of the COVID-19 pandemic. We are subject to risks related to the public health crises such as the global pandemic associated with the coronavirus (COVID-19). In December 2019, a novel strain of coronavirus, SARS-CoV-2, was reported to have surfaced in Wuhan, China. Since then, SARS-CoV-2, and the resulting disease COVID-19, has spread to most countries, and all 50 states within the United States. In March 2020, the World Health Organization declared the COVID-19 outbreak a pandemic. Further, the President of the United States declared the COVID-19 pandemic a national emergency, invoking powers under the Stafford Act, the legislation that directs federal emergency disaster response, and under the Defense Production Act, the legislation that facilitates the production of goods and services necessary for national security and for other purposes. Numerous governmental jurisdictions have imposed, and others in the future may impose, “shelter-in-place” orders, quarantines, executive orders and similar government orders and restrictions for their residents to control the spread of COVID-19. Most states and the federal government have declared a state of emergency related to the spread of COVID-19. Such orders or restrictions, and the perception that such orders or restrictions could occur, have resulted in business closures, work stoppages, slowdowns and delays, work-from-home policies, travel restrictions and cancellation of events, among other effects, thereby negatively impacting our customers, employees, and offices, among others. We may experience further limitations on employee resources in the future, because of sickness of employees or their families.

Healthcare organizations around the world, including our health care provider customers, have faced and will continue to face, substantial challenges in treating patients with COVID-19, such as the diversion of staff and resources from ordinary functions to the treatment of COVID-19, supply, resource and capital shortages and overburdening of staff and resource capacity. In the United States, governmental authorities have also recommended, and in certain cases required, that elective, specialty and other procedures and appointments, including certain primary care services, be suspended or canceled to avoid non-essential patient exposure to medical environments and potential infection with COVID-19 and to focus limited resources and personnel capacity toward the treatment of COVID-19. These measures and challenges will likely continue for the duration of the pandemic, which is uncertain, and will disproportionately harm the results of operations, liquidity and financial condition of these health care organizations and our health care provider customers. As a result, our health care provider customers may seek contractual accommodations from us in the future. To the extent such health care provider customers experience challenges and difficulties, it will adversely affect our business operation and results of operations. Further, a recession or prolonged economic contraction as a result of the COVID-19 pandemic could also harm the business and results of operations of our customers, resulting in potential business closures, layoffs of employees and a significant increase in unemployment in the United States which may continue even after the pandemic. The occurrence of any such events may lead to reduced income for customers and reduced size of workforces, which could reduce our revenue and harm our business, financial condition and results of operations.

The widespread COVID-19 pandemic has resulted in, and may continue to result in, significant volatility and uncertainty in U.S. financial markets, which may reduce our ability to access capital, which could in the future negatively affect our liquidity. In addition, a recession or market correction resulting from the spread of COVID-19 could materially affect our business and the value of our common stock.

Further, given the dislocation and government-imposed travel related limitations as a consequence of the COVID-19 pandemic, our ability to complete acquisitions in the near-term may be delayed. Future acquisitions may be subject to difficulties in evaluating potential acquisition targets as a result of the inability to accurately predict the duration or long-term economic and business consequences resulting from the COVID-19 pandemic.

The global outbreak of COVID-19 continues to rapidly evolve. We have taken steps intended to mitigate the effects of the pandemic and to protect our workforce. Although we believe we have taken the appropriate actions, we cannot guarantee that these measures will mitigate all or any negative effects of the pandemic. The ultimate impact of the COVID-19 pandemic or a similar health epidemic is highly uncertain and subject to change. We cannot at this time precisely predict what effects the COVID-19 outbreak will have on our business, results of operations and financial condition, including the uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the pandemic, the availability of vaccinations, and the governmental responses to the pandemic. However, we will continue to monitor the COVID-19 situation closely and are committed to continuing to make appropriate changes as and when needed.

| 12 |

We currently do not have sufficient cash to fully implement our business plan. We have experienced a lack of adequate capital resources causing us to be unable to fully implement our full business plan. We believe that we need to raise or otherwise obtain additional financing beyond our current cash position in order to satisfy our existing obligations and fully implement our business plan. We do not expect to have positive cash flow until the end of 2023 or longer. If we are not successful in obtaining additional financing, including pursuant to this offering, we will not be able to fully implement our business plan and we may not be able to continue our operations.

We may not secure the capital required to develop our business. Our business is dependent on securing additional capital. If we fail to secure the required capital, including in this offering, our business will fail.

Our business plan is not based on independent market studies. We have not commissioned any independent market studies concerning our business plans. Rather, our plans for implementing our business strategy and achieving profitability are based on the experience, judgment and assumptions of our management. If these assumptions prove to be incorrect, we may not be successful in our business operations.

Our Board of Directors may change our policies without shareholder approval. Our policies, including any policies with respect to investments, leverage, financing, growth, debt and capitalization, will be determined by our Board of Directors or officers to whom our Board of Directors delegate such authority. Our Board of Directors will also establish the amount of any dividends or other distributions that we may pay to our shareholders. Our Board of Directors or officers to which such decisions are delegated will have the ability to amend or revise these and our other policies at any time without shareholder vote. Accordingly, our shareholders will not be entitled to approve changes in our policies, which policy changes may have a material adverse effect on our financial condition and results of operations.

Risks Related to Our Organization and Structure

Our holding company structure makes us dependent on our subsidiaries for our cash flow and could serve to subordinate the rights of our shareholders to the rights of creditors of our subsidiaries, in the event of an insolvency or liquidation of any such subsidiary. Our company acts as a holding company and, accordingly, substantially all of our operations are conducted through our subsidiaries. Such subsidiaries will be separate and distinct legal entities. As a result, substantially all of our cash flow will depend upon the earnings of our subsidiaries. In addition, we will depend on the distribution of earnings, loans or other payments by our subsidiaries. No subsidiary will have any obligation to provide our company with funds for our payment obligations. If there is an insolvency, liquidation or other reorganization of any of our subsidiaries, our shareholders will have no right to proceed against their assets. Creditors of those subsidiaries will be entitled to payment in full from the sale or other disposal of the assets of those subsidiaries before our company, as a shareholder, would be entitled to receive any distribution from that sale or disposal.

Risks Related to a Purchase of the Offered Shares

The outstanding shares of our Series A-1 Supermajority Voting Preferred Stock preclude current and future owners of our common stock from influencing any corporate decision. Epizon Limited (see Note 5 to the ownership table under “Security Ownership of Certain Beneficial Owners and Management” for information concerning beneficial ownership and control of Epizon Limited) owns all of the outstanding shares of our Series A-1 Supermajority Voting Preferred Stock. The Series A-1 Supermajority Voting Preferred Stock has the following voting rights: so long as one share of Series A-1 Supermajority Voting Preferred Stock is outstanding, the outstanding share(s) of the Series A-1 Supermajority Voting Preferred Stock shall have the number of votes, in the aggregate, equal to 51% of all votes entitled to be voted at any meeting of our shareholder meeting. Epizon Limited will, therefore, be able to control the management and affairs of our company, as well as matters requiring the approval by our shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. (See “Security Ownership of Certain Beneficial Owners and Management”).

We may seek capital that may result in shareholder dilution or that may have rights senior to those of our common stock, including the Offered Shares. From time to time, we may seek to obtain additional capital, either through equity, equity-linked or debt securities. The decision to obtain additional capital will depend on, among other factors, our business plans, operating performance and condition of the capital markets. If we raise additional funds through the issuance of equity, equity-linked or debt securities, those securities may have rights, preferences or privileges senior to the rights of our common stock, which could negatively affect the market price of our common stock or cause our shareholders to experience dilution.

We do not intend to pay dividends on our common stock. We intend to retain earnings, if any, to provide funds for the implementation of our business strategy. We do not intend to declare or pay any dividends in the foreseeable future. Therefore, there can be no assurance that holders of our common stock will receive cash, stock or other dividends on their shares of our common stock, until we have funds which our Board of Directors determines can be allocated to dividends.

| 13 |

Our common stock has been, and may in the future be, a “Penny Stock” and subject to specific rules governing its sale to investors. The SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to our Common Stock, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a person’s account for transactions in penny stocks; and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person; and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination; and that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors sell shares of our common stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

There is minimal trading activity in our common stock and there is no assurance that an active market will develop in the future. Although our common stock is currently quoted on the OTC Pink marketplace of OTC Link (an interdealer electronic quotation system operated by OTC Markets Group, Inc.) under the symbol “VMCS”, trading of our common stock may be extremely sporadic. For example, several days may pass before any shares may be traded. As a result, an investor may find it difficult to dispose of, or to obtain accurate quotations of the price of our common stock. There can be no assurance that a more active market for our common stock will develop, or if one should develop, there is no assurance that it will be sustained. This severely limits the liquidity of our common stock, and would likely have a material adverse effect on the market price of our common stock and on our ability to raise additional capital.

The market for our common stock may be volatile; you could lose all or part of your investment in the Offered Shares. The market price of our common stock may fluctuate substantially and will depend on a number of factors many of which are beyond our control and may not be related to our operating performance. These fluctuations could cause you to lose all or part of your investment in the Offered Shares, since you might be unable to sell your Offered Shares at or above the price you pay for the Offered Shares. Factors that could cause fluctuations in the market price of our common stock include, but are not limited to, the following:

| ● | price and volume fluctuations in the overall stock market from time to time; | |

| ● | volatility in the market prices and trading volumes of small-company stocks; | |

| ● | changes in operating performance and stock market valuations of other similar companies generally; | |

| ● | sales of shares of our common stock by us or our shareholders; | |

| ● | failure of securities analysts to maintain coverage of us, changes in financial estimates by securities analysts who follow our company, or our failure to meet these estimates or the expectations of investors; | |

| ● | the financial projections we may provide to the public, any changes in those projections or our failure to meet those projections; | |

| ● | announcements by us or our competitors of new products or services; | |

| ● | the public’s reaction to our press releases, other public announcements and filings with the SEC; | |

| ● | rumors and market speculation involving us or other companies in our industry; | |

| ● | actual or anticipated changes in our operating results or fluctuations in our operating results; | |

| ● | actual or anticipated developments in our business, our competitors’ businesses or the competitive landscape generally; | |

| ● | litigation involving us, our industry or both, or investigations by regulators into our operations or those of our competitors; | |

| ● | developments or disputes concerning our intellectual property or other proprietary rights; | |

| ● | announced or completed acquisitions of businesses or technologies by us or our competitors; | |

| ● | new laws or regulations or new interpretations of existing laws or regulations applicable to our business; | |

| ● | changes in accounting standards, policies, guidelines, interpretations or principles; | |

| ● | any significant change in our management; and | |

| ● | general economic conditions and slow or negative growth of our markets. |

| 14 |

In addition, in the past, following periods of volatility in the overall market and the market price of a particular company’s securities, securities class action litigation has often been instituted against these companies. This litigation, if instituted against us, could result in substantial costs and a diversion of our management’s attention and resources.

Compliance with the reporting requirements of federal securities laws can be expensive. We are a public reporting company in the United States, and accordingly, subject to the information and reporting requirements of the Exchange Act and other federal securities laws, and the compliance obligations of the Sarbanes-Oxley Act. The costs of preparing and filing annual and quarterly reports and other required information with the SEC, furnishing audited reports to shareholders and preparing any registration statements from time to time, if any, are substantial.

Applicable regulatory requirements, including those contained in and issued under the Sarbanes-Oxley Act of 2002, may make it difficult for us to retain or attract qualified officers and directors, which could adversely affect the management of our business and our ability to obtain or retain listing of our common stock. We may be unable to attract and retain those qualified officers, directors and members of board committees required to provide for effective management because of the rules and regulations that govern publicly held companies, including, but not limited to, certifications by principal executive officers. The enactment of the Sarbanes-Oxley Act has resulted in the issuance of a series of related rules and regulations and the strengthening of existing rules and regulations by the SEC, as well as the adoption of new and more stringent rules by the stock exchanges. The perceived increased personal risk associated with these changes may deter qualified individuals from accepting roles as directors and executive officers.

Further, some of these changes heighten the requirements for board or committee membership, particularly with respect to an individual’s independence from the corporation and level of experience in finance and accounting matters. While certain board and committee requirements may not apply to us as an OTC listed company, we intend to explore voluntarily complying with some of these requirements. We may have difficulty attracting and retaining directors with the requisite qualifications. If we are unable to attract and retain qualified officers and directors, the management of our business and our ability to obtain or retain listing of our shares of common stock on any stock exchange (assuming we elect to seek and are successful in obtaining such listing) could be adversely affected.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or detect fraud, and, consequently, investors could lose confidence in our financial reporting and this may decrease the trading price of our common stock. We must maintain effective internal controls to provide reliable financial reports and detect fraud. We have been assessing our internal controls to identify areas that need improvement. We are in the process of implementing changes to internal controls, but have not yet completed implementing these changes. Failure to implement these changes to our internal controls or any others that it identifies as necessary to maintain an effective system of internal controls could harm our operating results and cause investors to lose confidence in our reported financial information. Any such loss of confidence would have a negative effect on the trading price of our stock.

Our Articles of Incorporation allows for our board to create new series of preferred stock without further approval by our shareholders, which could adversely affect the rights of the holders of our common stock, including purchasers of the Offered Shares. Our board of directors has the authority to issue shares of our preferred stock, with such relative rights and preferences as the board of directors may determine, without further shareholder approval. As a result, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders the preferred right to our assets upon liquidation and the right to receive dividend payments before dividends are distributed to the holders of our common stock. In addition, our board of directors could authorize the issuance of a series of preferred stock that has greater voting power than our common stock or that is convertible into our common stock, which could decrease the relative voting power of our common stock or result in dilution to our existing shareholders.

You will suffer dilution in the net tangible book value of the Offered Shares you purchase in this offering. If you acquire any Offered Shares, you will suffer immediate dilution, due to the lower book value per share of our common stock compared to the purchase price of the Offered Shares in this offering. (See “Dilution”).

Future issuances of debt securities and equity securities could negatively affect the market price of shares of our common stock and, in the case of equity securities, may be dilutive to existing shareholders. In the future, we may issue debt or equity securities or incur other financial obligations, including stock dividends. Upon liquidation, it is possible that holders of our debt securities and other loans and preferred stock would receive a distribution of our available assets before common shareholders. We are not required to offer any such additional debt or equity securities to existing shareholders on a preemptive basis. Therefore, additional common stock issuances, directly or through convertible or exchangeable securities, warrants or options, would dilute the holdings of our existing common shareholders and such issuances, or the perception of such issuances, could reduce the market price of shares of our common stock.