As filed with the Securities and Exchange Commission on July 27, 2023.

Registration No. 333-273288

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

InnovaQor, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 7373 | 88-0436055 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

400 South Australian Avenue, Suite 800

West Palm Beach, Florida 33401

(561) 421-1900

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Gerard Dab

Corporate Secretary

InnovaQor, Inc.

400 South Australian Avenue, Suite 800

West Palm Beach, Florida 33401

(561) 421-1905

(Name, address. including zip code, and telephone number,

including area code, of agent for service)

Copies to:

J. Thomas Cookson, Esq.

Shutts & Bowen LLP

200 South Biscayne Boulevard, Suite 4100

Miami, Florida 33131

Tel: (305) 379-9141

Approximate date of commencement of proposed sale to public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company ☒ | |||

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities, and we are not soliciting offers to buy these securities, in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | Subject to Completion | Dated JULY 27, 2023 |

81,651,000 Shares of Common Stock Offered by the Selling Stockholder

This prospectus relates to the resale, from time to time, by the selling stockholder listed in this prospectus under the section “Selling Stockholder,” of up to 81,651,000 shares of common stock, par value $.0001 per share, of InnovaQor, Inc., issuable upon the conversion of shares of Series B-1 Convertible Redeemable Preferred Stock, par value $.0001 per share (the “Series B-1 Preferred Stock”), which we issued to the Selling Stockholder in connection with the acquisition of the stock of Health Technology Solutions, Inc. and Advanced Molecular Services Group, Inc. on June 25, 2021.

Our common stock is traded on the OTC Pink under the symbol “INQR.” The last reported sales price of our common stock on July __, 2023 was $[●] per share. There were 244,953,286 shares of our common stock outstanding as of July 13, 2023.

The Selling Stockholder may sell the shares of common stock being offered by this prospectus from time to time on terms to be determined at the time of sale through ordinary brokerage transactions or through any other means described in this prospectus under “Plan of Distribution.” The Selling Stockholder may sell the common stock at a fixed price of $0.005 per share until our common stock is quoted on the OTCQB or OTCQX marketplace, or listed on a national securities exchange. Thereafter, the prices at which the Selling Stockholder may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions. We are not selling any securities under this prospectus and we will not receive any proceeds from the sale of the shares by the Selling Stockholder.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 2 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

___________

The date of this prospectus is ________, 2023

TABLE OF CONTENTS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC” or the “Commission”). By using such registration statement, the Selling Stockholder may, from time to time, offer and sell shares of our common stock pursuant to this prospectus. It is important for you to read and consider all of our information contained in this prospectus before making any decision whether to invest in the common stock. You should also read and consider the information contained in the documents that we have incorporated by reference as described in “Where You Can Find Additional Information,” and “Incorporation of Certain Information by Reference” in this prospectus.

We and the Selling Stockholder have not authorized anyone to give any information or to make any representations different from that which is contained or incorporated by reference in this prospectus in connection with the offer made by this prospectus and, if given or made, such information or representations must not be relied upon as having been authorized by InnovaQor, Inc. or the Selling Stockholder. Neither the delivery of this prospectus nor any sale made hereunder and thereunder shall under any circumstances create an implication that there has been no change in the affairs of InnovaQor, Inc. since the date hereof. You should assume that information contained in this prospectus is accurate only as of the date on the front cover hereof. Our business, financial condition, results of operations and prospects may have changed since that date. This prospectus does not constitute an offer or solicitation by anyone in any state in which such offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation.

| I |

This summary provides an overview of selected information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our securities. You should carefully read this prospectus and the registration statement of which this prospectus is a part in their entirety before investing in our securities, including the information discussed under “Risk Factors” and our financial statements and notes thereto that appear elsewhere in this prospectus or are incorporated by reference in this prospectus. Unless otherwise indicated herein, the terms “we,” “our,” “us,” or the “Company” refer to InnovaQor, Inc.

Our Company

Our company, InnovaQor, Inc., a Nevada corporation, was originally incorporated in the State of Nevada on September 7, 1999, under the name Ancona Mining Corporation. On November 30, 2004, our corporate name changed to VisualMED Clinical Solutions Corporation (“VisualMED”). On September 8, 2021, our corporate name changed to InnovaQor, Inc.

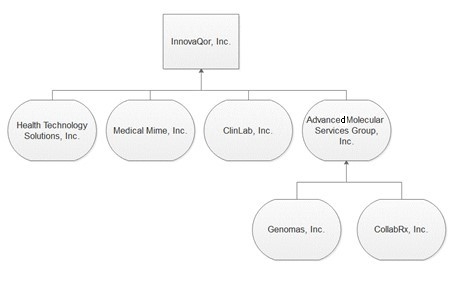

The Company provides information technology solutions and services to healthcare and laboratory customers in the United States. Our goal is to develop and deliver a technology-based network communication platform to a broad range of healthcare professionals and businesses using a subscription revenue model with added value bolt on services. The Company has initiated this project in the second quarter of 2023 and is working with a Canadian-based development company to create a minimum viable product (MVP) to demonstrate the peer-to-peer communication capabilities. The Company will launch this new platform under the name Curallo. The Company, through an acquisition that closed on June 25, 2021, has a number of fully developed products and services which it offers through three operating wholly-owned subsidiaries that provide medical support services primarily to clinical laboratories, corporate operations, rural hospitals, physician practices and behavioral health/substance abuse centers.

Each of the subsidiaries is wholly owned by the Company and complements each other, allowing for cross selling of products and services. The Company believes the current solutions will become an added value option to a technology-based network communication platform to a broad range of healthcare professionals and businesses using a subscription revenue model with added value bolt on services the Company plans to develop.

Corporate Information

The Company’s fiscal year-end is December 31.

Our principal executive offices are located at 400 South Australian Avenue, Suite 800, West Palm Beach, Florida 33401 and our telephone number is (561) 421-1900. Our website address is www.innovaqor.com. The information contained on, or that can be accessed through, our website is not part of this prospectus.

THE OFFERING

| Securities Offered by the Selling Stockholder | 81,651,000 shares of our Common Stock | |

| Offering Price per Share | The Selling Stockholder may sell all or a portion of the shares being offered by this prospectus at a fixed price of $0.005 per share until our Common Stock is quoted on the OTCQB or OTCQX marketplace, or listed on a national securities exchange. Thereafter, the prices at which the Selling Stockholder may sell the shares will be determined by the prevailing market price at the time of sale or at negotiated prices. See “Plan of Distribution.” |

| 1 |

| Use of Proceeds | We will not receive any of the proceeds from the sale by the Selling Stockholder of the shares of Common Stock. See “Use of Proceeds.” | |

| Stock Symbol | INQR | |

| Risk Factors | Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 2 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities. |

Investing in our securities involves a high degree of risk. You should carefully consider the following risk factors, as well as the other information in this prospectus, including our financial statements and related notes, which are incorporated by reference in this prospectus, before deciding whether to invest in our securities. Information in this prospectus may be amended, supplemented or superseded from time to time by reports we file with the SEC in the future. The occurrence of any of the adverse developments described in the following risk factors could materially and adversely harm our business, financial condition, results of operations or prospects. In that case, the trading price of our securities could decline, and you may lose all or part of your investment.

Going Concern Risk Factor

Although our financial statements have been prepared on a going concern basis, we have accumulated significant losses and have negative cash flows from operations that could adversely affect our ability to secure additional capital to fund our operations or limit our ability to react to changes in the economy or our industry. These or additional risks or uncertainties not presently known to us, or that we currently deem immaterial, raise substantial doubt about our ability to continue as a going concern.

Under Accounting Standards Update (“ASU”) 2014-15, Presentation of Financial Statements—Going Concern (Subtopic 205-40) Accounting Standards Codification (“ASC 205-40”), InnovaQor has the responsibility to evaluate whether conditions and/or events raise substantial doubt about its ability to meet its future financial obligations as they become due within one year after the date that the financial statements are issued. As required by ASC 205-40, this evaluation shall initially not take into consideration the potential mitigating effects of plans that have not been fully implemented as of the date the financial statements are issued. Management has assessed InnovaQor’s ability to continue as a going concern in accordance with the requirement of ASC 205-40.

The consolidated financial statements incorporated by reference in this prospectus have been prepared in accordance with U.S. GAAP and the rules and regulations of the SEC. The consolidated financial statements have been prepared using U.S. GAAP applicable to a going concern that contemplates the realization of assets and liquidation of liabilities in the normal course of business. InnovaQor has accumulated significant losses and has negative cash flows from operations. For the three months ended March 31, 2023, we incurred a net loss of $325,065 and, as of that date, we had an accumulated deficit of $19,949,146. For the years ended December 31, 2022 and 2021, we incurred a net loss of $1,613,931 and $845,843, respectively, and, as of such dates, we had an accumulated deficit of $19,624,081 and $18,010,150, respectively.

Additionally, we had net cash used in operating activities of $316,094 and $937,384 for the three months ended March 31, 2023, and the year ended December 31, 2022, respectively. At March 31, 2023, we had a working capital deficit of $4,733,862 and a shareholders’ deficit of $14,017,909. At December 31, 2022, we had a working capital deficit of $4,408,797 and a shareholders’ deficit of $13,692,844. Any losses in the future could cause the quoted price of our common stock to decline or have a material adverse effect on our financial condition, our ability to pay our debts as they become due, and on our cash flows.

In addition, the Company’s cash position is critically deficient and critical payments are not being made in the ordinary course of business, all of which raises substantial doubt about InnovaQor’s ability to continue as a going concern. Management’s plans with respect to alleviating the adverse financial conditions that caused management to express substantial doubt about InnovaQor’s ability to continue as a going concern are discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

| 2 |

InnovaQor has incurred substantial costs in connection with the acquisition of the Group which has included accounting, tax, legal and other professional services costs, recruiting and relocation costs associated with hiring key senior management personnel who are new to InnovaQor, tax costs and costs to separate information systems, among other costs. The cost of performing such functions is anticipated to be higher than the amounts reflected in InnovaQor’s historical financial statements, which would cause its future losses to increase. Accordingly, InnovaQor will continue to focus on increasing revenues.

There can be no assurance that InnovaQor will be able to achieve its business plan, raise any additional capital or secure the additional financing necessary to implement its current operating plan. The ability of InnovaQor to continue as a going concern is dependent upon its ability to significantly increase its revenues and eventually achieve profitable operations. The consolidated financial statements incorporated by reference in this prospectus do not include any adjustments that might be necessary if InnovaQor is unable to continue as a going concern.

Risks Related to this Offering

Our common stock is subject to substantial dilution by conversions of convertible preferred stock into common stock.

The Company has outstanding convertible preferred stock. Conversions of the convertible preferred stock could result in substantial dilution of our common stock and a decline in its market price. In addition, the terms of the convertible preferred stock provide for conversion prices that vary based upon the price of our common stock and which may be below the market price at the time of conversion. These provisions may result in significant dilution of our common stock.

The following table presents the dilutive effect of our various potential common shares as of March 31, 2023:

| March 31, 2023 | ||||

| Common shares outstanding | 244,951,286 | |||

| Dilutive potential shares: | ||||

| Series B-1 Preferred Stock | 3,257,080,610 | |||

| Series C-1 Preferred Stock | 49,019,607 | |||

| Total dilutive potential common shares, including outstanding common stock | 3,551,051,503 | |||

The sale of a substantial amount of our common stock, including resale of the shares of common stock issuable upon the conversion of the Series B-1 Preferred Stock held by the Selling Stockholder, in the public market could adversely affect the prevailing market price of our common stock.

Sales of substantial amounts of shares of our common stock in the public market, or the perception that such sales might occur, could adversely affect the market price of our common stock, and the market value of our other securities.

A substantial number of shares of common stock are being offered by this prospectus, and we cannot predict if and when the Selling Stockholder may sell such shares in the public markets. Furthermore, in the future, we may issue additional shares of common stock or other equity or debt securities convertible into common stock in connection with a financing, acquisition, litigation settlement, employee arrangement, or otherwise. Any such issuance could result in substantial dilution to our existing stockholders and could cause our stock price to decline.

| 3 |

General Business and Industry Risks

An inability to retain our senior management team would be detrimental to the success of our business.

We rely heavily on our senior management team; our ability to retain them is particularly important to our future success. Given the highly specialized nature of our services (Healthcare, IT), the senior management team must have a thorough understanding of our product and service offerings as well as the skills and experience necessary to manage an organization consisting of a diverse group of professionals and external parties. In addition, we rely on our senior management team to generate and market our business successfully in a crowded, complex and legislatively bound marketplace. Further, our senior management’s personal reputations and relationships with our clients are a critical element in obtaining and maintaining client engagements. If one or more members of our senior management team leave and we cannot replace them with a suitable candidate quickly, we could experience difficulty in securing and successfully completing engagements and managing our business properly, which could harm our business prospects and results of operations.

Our inability to hire and retain talented people in an industry where there is great competition for talent could have a serious negative effect on our prospects and results of operations.

Our business involves the delivery of software products and professional services and is labor intensive. Our success depends largely on our general ability to attract, develop, motivate, and retain highly skilled professionals. Further, we must successfully maintain the right mix of professionals with relevant experience and skill sets as we grow, as we expand into new service offerings, and as the market evolves. The loss of a significant number of our professionals, the inability to attract, hire, develop, train, and retain additional skilled personnel, or the failure to maintain the right mix of professionals could have a serious negative effect on us, including our ability to manage, staff, and successfully complete our existing engagements and obtain new engagements. Qualified professionals are in great demand, and we face significant competition for both senior and junior professionals with the requisite credentials and experience. Our principal competition for talent comes from other software and consulting firms as well as from organizations seeking to staff their internal professional positions. Many of these competitors may be able to offer significantly greater compensation and benefits or more attractive lifestyle choices, career paths, or geographic locations than we do. Therefore, we may not be successful in attracting and retaining the skilled persons we require to conduct and expand our operations successfully. Increasing competition for these revenue-generating professionals may also significantly increase our labor costs, which could negatively affect our margins and results of operations.

Additional hiring, departures, business acquisitions and dispositions could disrupt our operations, increase our costs or otherwise harm our business.

Our business strategy is dependent in part upon our ability to grow by hiring individuals or groups of individuals and by acquiring complementary businesses. However, we may be unable to identify, hire, acquire, or successfully integrate new employees and acquired businesses without substantial expense, delay, or other operational or financial obstacles. From time to time, we will evaluate the total mix of products and services we provide and we may conclude that businesses may not achieve the results we previously expected. Competition for future hiring and acquisition opportunities in our markets could increase the compensation we offer to potential employees or the prices we pay for businesses we wish to acquire. In addition, we may be unable to achieve the financial, operational, and other benefits we anticipate from any hiring or acquisition, as well as any disposition, including those we have completed so far. New acquisitions could also negatively impact existing practices and cause current employees to depart. Hiring additional employees or acquiring businesses could also involve a number of additional risks, including:

| ● | the diversion of management’s time, attention, and resources from managing and marketing our Company; | |

| ● | the failure to retain key acquired personnel or existing personnel who may view the acquisition unfavorably; | |

| ● | the potential loss of clients of acquired businesses; | |

| ● | the need to compensate new employees while they wait for their restrictive covenants with other institutions to expire; |

| 4 |

| ● | the potential need to raise significant amounts of capital to finance a transaction or the potential issuance of equity securities that could be dilutive to our existing shareholders; | |

| ● | increased costs to improve, coordinate, or integrate managerial, operational, financial, and administrative systems; | |

| ● | the potential assumption of liabilities of an acquired business; | |

| ● | the inability to attain the expected synergies with an acquired business; | |

| ● | the usage of earn-outs based on the future performance of our business acquisitions may deter the acquired company from fully integrating into our existing business; | |

| ● | the perception of inequalities if different groups of employees are eligible for different benefits and incentives or are subject to different policies and programs; and | |

| ● | difficulties in integrating diverse backgrounds and experiences of consultants, including if we experience a transition period for newly hired consultants that results in a temporary drop in our utilization rates or margins. |

Determining the fair value of a reporting unit requires us to make significant judgments, estimates, and assumptions. While we believe that the estimates and assumptions underlying our valuation methodology are reasonable, these estimates and assumptions could have a significant impact on whether or not a non-cash goodwill impairment charge is recognized and also the magnitude of any such charge. The results of an impairment analysis are as of a point in time. There is no assurance that the actual future earnings or cash flows of our reporting units will be consistent with our projections. We will monitor any changes to our assumptions and will evaluate goodwill as deemed warranted during future periods. Any significant decline in our operations could result in non-cash goodwill impairment charges.

Changes in capital markets, legal or regulatory requirements, and general economic or other factors beyond our control could reduce demand for our services, in which case our revenues and profitability could decline.

A number of factors outside of our control affect demand for our services. These include:

| ● | fluctuations in the U.S. economy; | |

| ● | the U.S. or global financial markets and the availability, costs, and terms of credit; | |

| ● | changes in laws and regulations; and | |

| ● | other economic factors and general business conditions. |

We are not able to predict the positive or negative effects that future events or changes to the U.S. economy, financial markets, or regulatory and business environment could have on our operations.

Changes in U.S. tax laws could have a material adverse effect on our business, cash flow, results of operations and financial condition.

We are subject to income and other taxes in the U.S. at the state and federal level. Changes in applicable U.S. state or federal tax laws and regulations, or their interpretation and application, could materially affect our tax expense and profitability. The Company has not filed its federal tax returns for more than 10 years. The Company does not anticipate material adjustments of its tax liabilities when such returns are filed, but there is no guarantee that such filings will not have a material adverse effect.

| 5 |

Acquisition of the HTS Group has presented and will continue to present management with new challenges that did not exist under the umbrella of its former parent.

Under the former parent, management had the support of an experienced financial team, HR support and support for SEC filings. This support system does not currently exist in the current company and new challenges are presenting themselves every day. The immature knowledge and experience in these areas are likely to take longer to complete actions and will take management’s attention away from the day to day operations where it is needed to improve revenues.

If we are unable to manage fluctuations in our business successfully, we may not be able to achieve profitability.

To successfully manage growth, we must periodically adjust and strengthen our operating, financial, accounting, and other systems, procedures, and controls, which could increase our costs and may adversely affect our gross profits and our ability to achieve profitability if we do not generate increased revenues to offset the costs. As a public company, our information and control systems must enable us to prepare accurate and timely financial information and other required disclosures. If we discover deficiencies in our existing information and control systems that impede our ability to satisfy our reporting requirements, we must successfully implement improvements to those systems in an efficient and timely manner.

The nature of our services and the general economic environment make it difficult to predict our future operating results. To achieve profitability, we must:

| ● | attract, integrate, retain, and motivate highly qualified professionals; | |

| ● | achieve and maintain adequate utilization and suitable billing rates for our revenue-generating professionals; | |

| ● | expand our existing relationships with our clients and identify new clients in need of our services; | |

| ● | successfully resell products/engagements and secure new client sales/engagements every year; | |

| ● | maintain and enhance our brand recognition; and | |

| ● | adapt quickly to meet changes in our markets, our business mix, the economic environment, the credit markets, and competitive developments. |

Our financial results could suffer if we are unable to achieve or maintain adequate utilization and suitable billing rates for our products and services.

Our profitability depends to a large extent on the utilization and billing rates of our professionals. Utilization of our professionals is affected by a number of factors, including:

| ● | the number and size of client sales/engagements; | |

| ● | the timing of the commencement, completion and termination of engagements, which in many cases is unpredictable; | |

| ● | our ability to transition our consultants efficiently from completed engagements to new engagements; | |

| ● | the hiring of additional consultants because there is generally a transition period for new consultants that results in a temporary drop in our utilization rate; | |

| ● | unanticipated changes in the scope of client engagements; | |

| ● | our ability to forecast demand for our services and thereby maintain an appropriate level of consultants; and | |

| ● | conditions affecting the industries in which we practice as well as general economic conditions. |

| 6 |

The billing rates of our consultants that we are able to charge are also affected by a number of factors, including:

| ● | our clients’ perception of our ability to add value through our products/services; | |

| ● | the market demand for the products/services we provide; | |

| ● | an increase in the number of sales/engagements in the government sector, which are subject to federal contracting regulations; | |

| ● | introduction of new products/services by us or our competitors; | |

| ● | our competition and the pricing policies of our competitors; and | |

| ● | current economic conditions. |

If we are unable to achieve and maintain adequate overall utilization as well as maintain or increase the billing rates for our consultants, our financial results could materially suffer. In addition, our consultants may need to perform services at the physical locations of our clients. If there are natural disasters, disruptions to travel and transportation or problems with communications systems, our ability to perform services for, and interact with, our clients at their physical locations may be negatively impacted which could have an adverse effect on our business and results of operations.

It is likely that our quarterly results of operations may fluctuate in the future as a result of certain factors, some of which may be outside of our control.

A key element of our strategy is to market our products and services directly to certain specific organizations, such as health systems and hospitals, and to increase the number of our products and services utilized by existing clients. The sales cycle for some of our products and services is often lengthy and may involve significant commitment of client personnel. As a consequence, the commencement date of a client engagement often cannot be accurately forecasted. Certain of our client contracts contain terms that result in revenue that is deferred and cannot be recognized until the occurrence of certain events. As a result, the period of time between contract signing and recognition of associated revenue may be lengthy, and we are not able to predict with certainty the period in which revenue will be recognized.

Certain of our contracts provide that some portion or all of our fees are at risk if our services do not result in the achievement of certain performance targets. To the extent that any revenue is contingent upon the achievement of a performance target, we only recognize revenue upon client confirmation that the performance targets have been achieved. If a client fails to provide such confirmation in a timely manner, our ability to recognize revenue will be delayed.

Fee discounts, pressure to not increase or even decrease our rates, and less advantageous contract terms could result in the loss of clients, lower revenues and operating income, higher costs, and less profitable engagements. More discounts or write-offs than we expect in any period would have a negative impact on our results of operations.

Other fluctuations in our quarterly results of operations may be due to a number of other factors, some of which are not within our control, including:

| ● | the timing and volume of client invoices processed and payments received, which may affect the fees payable to us under certain of our engagements; | |

| ● | client decisions regarding renewal or termination of their contracts; | |

| ● | the amount and timing of costs related to the development or acquisition of technologies or businesses; and | |

| ● | unforeseen legal expenses, including litigation and other settlement gains or losses. |

| 7 |

The profitability of our fixed-fee engagements with clients may not meet our expectations if we underestimate the cost of these engagements.

When making proposals for fixed-fee engagements, we estimate the costs and timing for completing the engagements. These estimates reflect our best judgment regarding the efficiencies of our methodologies and consultants as we plan to deploy them on engagements. Any increased or unexpected costs or unanticipated delays in connection with the performance of fixed-fee engagements, including delays caused by factors outside our control, could make these contracts less profitable or unprofitable, which would have an adverse effect on our profit margin.

Our business is becoming increasingly dependent on information technology and will require additional investments in order to grow and meet the demands of our clients.

We depend on the use of sophisticated technologies and systems. Some of our services may become dependent on the use of software applications and systems that we do not own and could become unavailable. Moreover, our technology platforms will require continuing investments by us in order to expand existing service offerings and develop complementary services. Our future success depends on our ability to adapt our services and infrastructure while continuing to improve the performance, features, and reliability of our services in response to the evolving demands of the marketplace.

Adverse changes to our relationships with key third-party vendors, or in the business of our key third-party vendors, could unfavorably impact our business.

A portion of our services and solutions depends on technology or software provided by third-party vendors. Some of these third-party vendors refer potential clients to us, and others require that we obtain their permission prior to accessing their software. These third-party vendors could terminate their relationship with us without cause and with little or no notice, which could limit our service offerings and harm our financial condition and operating results. In addition, if a third-party vendor’s business changes or is reduced, that could adversely affect our business. Moreover, if third-party technology or software that is important to our business does not continue to be available or utilized within the marketplace, or if the services that we provide to clients are no longer relevant in the marketplace, our business may be unfavorably impacted.

We could experience system failures, service interruptions, or security breaches that could negatively impact our business.

Our organization is comprised of employees who work on matters throughout the United States. We may be subject to disruption to our operating systems from technology events that are beyond our control, including the possibility of failures at third-party data centers, disruptions to the Internet, natural disasters, power losses, and malicious attacks. In addition, despite the implementation of security measures, our infrastructure and operating systems, including the Internet and related systems, may be vulnerable to physical break-ins, hackers, improper employee or contractor access, computer viruses, programming errors, denial-of-service attacks, or other attacks by third parties seeking to disrupt operations or misappropriate information or similar physical or electronic breaches of security. While we have taken and are taking reasonable steps to prevent and mitigate the damage of such events, including implementation of system security measures, information backup, and disaster recovery processes, those steps may not be effective and there can be no assurance that any such steps can be effective against all possible risks. We will need to continue to invest in technology in order to achieve redundancies necessary to prevent service interruptions. Access to our systems as a result of a security breach, the failure of our systems, or the loss of data could result in legal claims or proceedings, liability, or regulatory penalties and disrupt operations, which could adversely affect our business and financial results.

Our reputation could be damaged and we could incur additional liabilities if we fail to protect client and employee data through our own accord or if our information systems are breached.

We rely on information technology systems to process, transmit, and store electronic information and to communicate among our locations and with our clients, partners, and employees. The breadth and complexity of this infrastructure increases the potential risk of security breaches which could lead to potential unauthorized disclosure of confidential information.

| 8 |

In providing services to clients, we may manage, utilize, and store sensitive or confidential client or employee data, including personal data and protected health information. As a result, we are subject to numerous laws and regulations designed to protect this information, such as the U.S. federal and state laws governing the protection of health or other personally identifiable information, including the Health Insurance Portability and Accountability Act (HIPAA). In addition, many states, and U.S. federal governmental authorities have adopted, proposed or are considering adopting or proposing, additional data security and/or data privacy statutes or regulations. Continued governmental focus on data security and privacy may lead to additional legislative and regulatory action, which could increase the complexity of doing business. The increased emphasis on information security and the requirements to comply with applicable U.S. data security and privacy laws and regulations may increase our costs of doing business and negatively impact our results of operations.

These laws and regulations are increasing in complexity and number. If any person, including any of our employees, negligently disregards or intentionally breaches our established controls with respect to client or employee data, or otherwise mismanages or misappropriates that data, we could be subject to significant monetary damages, regulatory enforcement actions, fines, and/or criminal prosecution.

In addition, unauthorized disclosure of sensitive or confidential client or employee data, whether through systems failure, employee negligence, fraud, or misappropriation, could damage our reputation and cause us to lose clients and their related revenue in the future.

Changes in capital markets, legal or regulatory requirements, general economic conditions and monetary or geo-political disruptions, as well as other factors beyond our control, could reduce demand for our practice offerings or services, in which case our revenues and profitability could decline.

Different factors outside of our control could affect demand for our practices and our services. These include:

| ● | fluctuations in the U.S. economy, including economic recessions and the strength and rate of any general economic recoveries; | |

| ● | the U.S. financial markets and the availability, costs and terms of credit and credit modifications; | |

| ● | business and management crises, including the occurrence of alleged fraudulent or illegal activities and practices; | |

| ● | new and complex laws and regulations, repeals of existing laws and regulations or changes of enforcement of laws, rules and regulations; | |

| ● | other economic, geographic or political factors; and | |

| ● | general business conditions. |

We are not able to predict the positive or negative effects that future events or changes to the U.S. economy will have on our business. Fluctuations, changes and disruptions in financial, credit, mergers and acquisitions and other markets, political instability and general business factors could impact various operations and could affect such operations differently. Changes to factors described above, as well as other events, including by way of example, contractions of regional economies, monetary systems, banking, real estate and retail or other industries; debt or credit difficulties or defaults by businesses; new, repeals of or changes to laws and regulations, including changes to the bankruptcy and competition laws of the U.S.; tort reform; banking reform; a decline in the implementation or adoption of new laws or regulations, or in government enforcement, litigation or monetary damages or remedies that are sought; or political instability may have adverse effects on our business.

| 9 |

Our revenues, operating income and cash flows are likely to fluctuate.

We expect to experience fluctuations in our revenues and cost structure and the resulting operating income and cash flows. We may experience fluctuations in our annual and quarterly financial results, including revenues, operating income and earnings per share, for reasons that include (i) the types and complexity, number, size, timing and duration of client engagements; (ii) the timing of revenue recognition under accounting principles generally accepted in the United States of America (“U.S. GAAP”); (iii) the utilization of revenue-generating professionals, including the ability to adjust staffing levels up or down to accommodate our business and prospects; (iv) the time it takes before a new hire becomes profitable; (v) the geographic locations of our clients or the locations where services are rendered; (vi) billing rates and fee arrangements, including the opportunity and ability to successfully reach milestones and complete projects, and collect for them; (vii) the length of billing and collection cycles and changes in amounts that may become uncollectible; (viii) changes in the frequency and complexity of government regulatory and enforcement activities; and (ix) economic factors beyond our control.

We may also experience fluctuations in our operating income and related cash flows because of increases in employee compensation, including changes to our incentive compensation structure and the timing of incentive payments. Also, the timing of investments or acquisitions and the cost of integrating them may cause fluctuations in our financial results, including operating income and cash flows. This volatility may make it difficult to forecast our future results with precision and to assess accurately whether increases or decreases in any one or more quarters are likely to cause annual results to exceed or fall short of expectations.

If we do not effectively manage the utilization of our professionals or billable rates, our financial results could decline.

Our failure to manage the utilization of our professionals who bill on an hourly basis, or maintain or increase the hourly rates we charge our clients for our services, could result in adverse consequences, such as non- or lower-revenue-generating professionals, increased employee turnover, fixed compensation expenses in periods of declining revenues, the inability to appropriately staff engagements (including adding or reducing staff during periods of increased or decreased demand for our services), or special charges associated with reductions in staff or operations. Reductions in workforce or increases of billable rates will not necessarily lead to savings. In such events, our financial results may decline or be adversely impacted. A number of factors affect the utilization of our professionals. Some of these factors we cannot predict with certainty, including general economic and financial market conditions; the complexity, number, type, size and timing of client engagements; the level of demand for our services; appropriate professional staffing levels, in light of changing client demands and market conditions; and competition and acquisitions. In addition, any expansion into or within locations where we are not well-known or where demand for our services is not well-developed could also contribute to low or lower utilization rates.

InnovaQor may enter into engagements which involve non-time and material arrangements, such as fixed fees and time and materials with caps. Failure to effectively manage professional hours and other aspects of alternative fee engagements may result in the costs of providing such services exceeding the fees collected by InnovaQor. Failure to successfully complete or reach milestones with respect to contingent fee or success fee assignments may also lead to lower revenues or the costs of providing services under those types of arrangements may exceed the fees collected by InnovaQor.

We may receive requests to discount our fees or to negotiate lower rates for our services and to agree to contract terms relative to the scope of services and other terms that may limit the size of an engagement or our ability to pass through costs. We will consider these requests on a case-by-case basis. In addition, our clients and prospective clients may not accept rate increases that we put into effect or plan to implement in the future. Fee discounts, pressure not to increase or even decrease our rates, and less advantageous contract terms could result in the loss of clients, lower revenues and operating income, higher costs and less profitable engagements. More discounts or write-offs than we expect in any period would have a negative impact on our results of operations. There is no assurance that significant client engagements will be renewed or replaced in a timely manner or at all, or that they will generate the same volume of work or revenues, or be as profitable as past engagements.

Our Company faces certain risks, including (i) industry consolidation and a heightened competitive environment, (ii) downward pricing pressure, (iii) technology changes and obsolescence, (iv) failure to protect client information against cyber-attacks and (v) failure to protect IP, which individually or together could cause the financial results and prospects of the Company to decline.

Our Company is facing significant competition from other consulting and/or software providers. There continues to be significant consolidation of companies providing products and services similar to those offered by our Company, which may provide competitors access to greater financial and other resources than those of InnovaQor. This industry is subject to significant and rapid innovation. Larger competitors may be able to invest more in research and development, react more quickly to new regulatory or legal requirements and other changes, or innovate more quickly and efficiently. Our Medical Mime and ClinLab software have been facing significant competition from competing software products.

| 10 |

The software and products of our Company are subject to rapid technological innovation. There is no assurance that we will successfully develop new versions of our Medical Mime and ClinLab software or other products. Our software may not keep pace with necessary changes and innovation. There is no assurance that new, innovative or improved software or products will be developed, compete effectively with the software and technology developed and offered by competitors, be price competitive with other companies providing similar software or products, or be accepted by our clients or the marketplace. If InnovaQor is unable to develop and offer competitive software and products or is otherwise unable to capitalize on market opportunities, the impact could adversely affect our operating margins and financial results.

Our reputation for providing secure information storage and maintaining the confidentiality of proprietary, confidential and trade secret information is critical to the success of our Company, which hosts client information as a service. We may face cyber-based attacks and attempts by hackers and similar unauthorized users to gain access to or corrupt our information technology systems. Such attacks could disrupt our business operations, cause us to incur unanticipated losses or expenses, and result in unauthorized disclosures of confidential or proprietary information. Although we seek to prevent, detect and investigate these network security incidents, and have taken steps to mitigate the likelihood of network security breaches, there can be no assurance that attacks by unauthorized users will not be attempted in the future or that our security measures will be effective.

We rely on a combination of copyrights, trademarks, trade secrets, confidentiality and other contractual provisions to protect our assets. Our software and related documentation will be protected principally under trade secret and copyright laws, which afford only limited protection, and the laws of some foreign jurisdictions provide less protection for our proprietary rights than the laws of the U.S. Unauthorized use and misuse of our IP by employees or third parties could have a material adverse effect on our business, financial condition and results of operations. The available legal remedies for unauthorized or misuse of our IP may not adequately compensate us for the damages caused by unauthorized use.

If we (i) fail to compete effectively, including by offering our software and services at a competitive price, (ii) are unable to keep pace with industry innovation and user requirements, (iii) are unable to replace clients or revenues as engagements end or are canceled or the scope of engagements are curtailed, or (iv) are unable to protect our clients’ or our own IP and proprietary information, the financial results of InnovaQor would be adversely affected. There is no assurance that we can replace clients or the revenues from engagements, eliminate the costs associated with those engagements, find other engagements to utilize our professionals, develop competitive products or services that will be accepted or preferred by users, offer our products and services at competitive prices, or continue to maintain the confidentiality of our IP and the information of our clients.

We may not manage our growth effectively, and our profitability may suffer.

Periods of expansion may strain our management team, or human resources and information systems. To manage growth successfully, we may need to add qualified managers and employees and periodically update our operating, financial and other systems, as well as our internal procedures and controls. We also must effectively motivate, train and manage a larger professional staff. If we fail to add or retain qualified managers, employees and contractors when needed, estimate costs, or manage our growth effectively, our business, financial results and financial condition may suffer.

We cannot assure that we can successfully manage growth through acquisitions and the integration of the companies and assets we acquire or that they will result in the financial, operational and other benefits that we anticipate. Some acquisitions may not be immediately accretive to earnings, and some expansion may result in significant expenditures.

| 11 |

In periods of declining growth, underutilized employees and contractors may result in expenses and costs being a greater percentage of revenues. In such situations, we will have to weigh the benefits of decreasing our workforce or limiting our service offerings and saving costs against the detriment that InnovaQor could experience from losing valued professionals and their industry expertise and clients.

We currently do not have sufficient cash to fully implement our business plan.

We have experienced a lack of adequate capital resources causing us to be unable to fully implement our full business plan. We believe that we need to raise or otherwise obtain additional financing beyond our current cash position in order to satisfy our existing obligations and fully implement our business plan. We do not expect to have positive cash flow during 2023 or longer. If we are not successful in obtaining additional financing, we will not be able to fully implement our business plan and we may not be able to continue our operations.

We may not secure the capital required to develop our business.

Our business is dependent on securing additional capital. If we fail to secure the required capital our business will fail.

Reliance on related party.

We rely heavily on Rennova, the former owner of our subsidiaries, for our current revenues and for the provision of loans necessary for us to operate our business until we secure our own capital. A loss of the contracts for service with Rennova or a loss of financial support would have a material adverse effect on our operations and business.

Our business plan is not based on independent market studies.

We have not commissioned any independent market studies concerning our business plans. Rather, our plans for implementing our business strategy and achieving profitability are based on the experience, judgment and assumptions of our management. If these assumptions prove to be incorrect, we may not be successful in our business operations.

Our Board of Directors may change our policies without shareholder approval.

Our policies, including any policies with respect to investments, leverage, financing, growth, debt and capitalization, will be determined by our Board of Directors or officers to whom our Board of Directors delegate such authority. Our Board of Directors will also establish the amount of any dividends or other distributions that we may pay to our shareholders. Our Board of Directors or officers to which such decisions are delegated will have the ability to amend or revise these and our other policies at any time without shareholder vote. Accordingly, our shareholders will not be entitled to approve changes in our policies, which policy changes may have a material adverse effect on our financial condition and results of operation.

Risks Related to Our Organization and Structure

Our holding company structure makes us dependent on our subsidiaries for our cash flow and could serve to subordinate the rights of our shareholders to the rights of creditors of our subsidiaries, in the event of an insolvency or liquidation of any such subsidiary.

Our Company acts as a holding company and, accordingly, substantially all of our operations are conducted through our subsidiaries. Such subsidiaries are separate and distinct legal entities. As a result, substantially all of our cash flow will depend upon the earnings of our subsidiaries. In addition, we will depend on the distribution of earnings, loans or other payments by our subsidiaries. No subsidiary will have any obligation to provide our Company with funds for our payment obligations. If there is an insolvency, liquidation or other reorganization of any of our subsidiaries, our shareholders will have no right to proceed against their assets. Creditors of those subsidiaries will be entitled to payment in full from the sale or other disposal of the assets of those subsidiaries before our Company, as a shareholder, would be entitled to receive any distribution from that sale or disposal.

| 12 |

Risks Related to Our Common Stock

We may seek capital that may result in shareholder dilution or that may have rights senior to those of our common stock.

From time to time, we may seek to obtain additional capital, either through equity, equity-linked or debt securities. The decision to obtain additional capital will depend on, among other factors, our business plans, operating performance and condition of the capital markets. If we raise additional funds through the issuance of equity, equity-linked or debt securities, those securities may have rights, preferences or privileges senior to the rights of our common stock, which could \negatively affect the market price of our common stock or cause our shareholders to experience dilution.

Our stock is considered a “penny stock,” and is therefore considered risky.

OTC Pink Sheet stocks, and especially those being offered for less than $5.00 per share, are often known as “penny stocks” and are subject to regulations which mandate the dispersion of certain disclosures to potential investors prior to any investor’s purchase of any penny stocks. Penny stocks are low-priced securities with low trading volume. Consequently, the price of the stock is often volatile and investors may be unable to buy or sell the stock when you desire. The SEC extensively monitors “penny stocks,” and such regulations are enumerated in Exchange Act Section 15(h) and Exchange Act Rules 3a51-1 and 15g-1 through 15g-100. With certain exceptions, brokers selling our stock must adhere to the SEC’s “penny stock” regulations, which requirements include, but are not limited to, the following:

| ● | Brokers must provide you with a risk disclosure document relating to the penny stock market. | |

| ● | Brokers must disclose price quotations and other information relating to the penny stock market. | |

| ● | Brokers must disclose any compensation they receive from the sale of our stock. | |

| ● | Brokers must provide a disclosure of any compensation paid to any associated persons in connection with transactions relating to our stock. | |

| ● | Brokers must provide you with quarterly account statements. | |

| ● | Brokers may not sell any of our stock that is held in escrow or trust accounts. | |

| ● | Prior to selling our stock, brokers must approve your account for buying and selling penny stocks. | |

| ● | Brokers must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. |

These additional sales practices and the disclosure requirements could impede the sale of our securities. In addition, the liquidity for our securities may be adversely affected, with related adverse effects on the price of our securities.

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend their customers buy our common stock, which may have the effect of reducing the trading activity in our common stock. As a result, fewer broker-dealers may be willing to make a market in our common stock, reducing a stockholder’s ability to resell shares of our common stock, thereby potentially reducing the liquidity of our common stock.

| 13 |

As an issuer of penny stock, the protection provided by the federal securities laws relating to forward-looking statements does not apply to us.

Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, we will not have the benefit of this safe harbor protection, in the event of any legal action based upon a claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

We have no plans to pay dividends on our Common Stock.

We have not previously paid any cash dividends, nor have we determined to pay dividends on any share of preferred stock or shares of Common Stock. There can be no assurance that our operations will result in sufficient revenues to enable us to operate at profitable levels or to generate positive cash flows. Furthermore, there is no assurance that the Board of Directors will declare dividends even if profitable. Dividend policy is subject to the discretion of our Board of Directors and will depend on, among other things, our earnings, financial condition, capital requirements and other factors.

If we issue additional shares in the future, it will result in the dilution of our existing shareholders.

InnovaQor has authorized 2,000,000,000 shares of $0.0001 par value Common Stock of which 244,953,286 were issued and outstanding as of each of March 31, 2023 and December 31, 2022. These shares have one vote per share. The issuance of any such shares may result in a reduction of the book value and the market price of our outstanding shares of our common stock. The Company’s authorized shares of Common Stock was increased from 325,000,000 to 2,000,000,000 shares on June 29, 2023.

Our common stock is subject to conversion of other securities into common stock.

The Company has outstanding convertible preferred stock. Conversions of the convertible preferred stock could result in substantial dilution of our common stock and a decline in its market price. Our Board of Directors, upon the approval of the shareholders, may seek again to change the number of authorized shares in the future, may seek to adjust the number of shares issued, and may choose to issue shares to acquire one or more businesses or to provide additional financing in the future. The issuance of any such shares may result in a reduction of market price of the outstanding shares of our common stock. If we issue any such additional shares, such issuance will cause a reduction in the proportionate ownership of current shareholders.

Voting power is highly concentrated in holders of our Series A-1 Preferred Stock.

InnovaQor has authorized 1,000 shares of $0.0001 par value (stated value $10) Series A-1 Supermajority Voting Preferred Stock of which 1,000 were issued and outstanding as of March 31, 2023 and December 31, 2022. So long as one share of Series A-1 Preferred Stock is outstanding, the outstanding shares of the Series A-1 Preferred Stock shall have the number of votes, in the aggregate, equal to 51% of all votes of all classes of shares entitled to be voted at any stockholder meeting or action by written consent. These shares have no rights to receive dividends and liquidation rights are equal to the stated value per share. Such concentrated control of InnovaQor may adversely affect the price of our common stock. Epizon Limited will be able to exercise control over all matters submitted for stockholder approval. A stockholder that acquires common stock will not have an effective voice in the management of InnovaQor. Seamus Lagan is the managing director of Epizon Limited.

| 14 |

We are a “smaller reporting company” and we cannot be certain if the reduced disclosure requirements applicable to smaller reporting companies will make our Common Stock less attractive to investors.

We are a “smaller reporting company,” as defined in Rule 12b-2 under the Exchange Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including “emerging growth companies” such as, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. Our status as a smaller reporting company is determined on an annual basis. We cannot predict if investors will find our Common Stock less attractive or our Company less comparable to certain other public companies because we will rely on these exemptions. For example, if we do not adopt a new or revised accounting standard, our future financial results may not be as comparable to the financial results of certain other companies in our industry that adopted such standards. If some investors find our Common Stock less attractive as a result, there may be a less active trading market for our Common Stock and our stock price may be more volatile.

The requirements of being a reporting public company may strain our resources, divert management’s attention and affect our ability to attract and retain additional executive management and qualified board members.

As a reporting public company, we will be subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act, and the Dodd-Frank Act, and other applicable securities rules and regulations. Compliance with these rules and regulations will increase our legal and financial compliance costs, make some activities more difficult, time-consuming, or costly and increase demand on our systems and resources, particularly after we are no longer a “smaller reporting company.” The Exchange Act requires, among other things, that we file annual, quarterly, and current reports with respect to our business and results of operations. As a “smaller reporting company,” we receive certain reporting exemptions under the Sarbanes-Oxley Act.

Changing laws, regulations and standards relating to corporate governance and public disclosure create uncertainty for public companies, increase legal and financial compliance costs and increase time expenditures for internal personnel. These laws, regulations and standards are subject to interpretation, in many cases due to their lack of specificity, and their application in practice may evolve over time as regulators and governing bodies provide new guidance. These changes may result in continued uncertainty regarding compliance matters and may necessitate higher costs due to ongoing revisions to filings, disclosures and governance practices. We intend to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expenses and a diversion of management’s time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to their application and practice, regulatory authorities may initiate regulatory or legal proceedings against us and our business may be adversely affected.

As a public company under these rules and regulations, we expect that it may make it more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage, incur substantially higher costs to obtain coverage or determine not to obtain such coverage. These factors could also make it more difficult for us to attract and retain qualified members of our Board of Directors, and could also make it more difficult to attract qualified executive officers.

Our stock price may be volatile, which may result in losses to our shareholders.

The stock markets have experienced and may experience significant price and trading volume fluctuations, and the market prices of companies quoted on the Pink Tier of the OTC Marketplace, which is where our stock is currently quoted, have experienced sharp share price and trading volume changes. The trading price of our common stock is likely to be volatile and could fluctuate widely in response to many factors both in and outside of our control, and include but are not limited to the following:

| ● | variations in our operating results; |

| 15 |

| ● | changes in expectations of our future financial performance, including financial estimates by securities analysts and investors; | |

| ● | changes in operating and stock price performance of other companies in our industry; | |

| ● | additions or departures of key personnel; and | |

| ● | future sales of our common stock. |

Stock markets often experience significant price and volume fluctuations. These fluctuations, as well as general economic and political conditions unrelated to our performance, may adversely affect the price of our common stock.

Volatility in the price of our common stock may subject us to securities litigation.

The market for our common stock may be characterized by significant price volatility as compared to seasoned issuers, and we expect that our share price will be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

Our common stock may become thinly traded and you may be unable to sell at or near ask prices, or at all.

We cannot predict the extent to which an active public market for trading our common stock will be sustained. The trading volume of our common stock may be sporadically or “thinly-traded,” meaning that the number of persons interested in purchasing our common stock at or near bid prices at certain given time may be relatively small or non-existent.

This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stockbrokers, institutional investors and others in the investment community who generate or influence sales volume. Even if we came to the attention of such persons, those persons may be reluctant to follow, purchase, or recommend the purchase of shares of an unproven company such as ours until such time as we become more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained.

The market price for our common stock may become volatile given our status as a relatively small company, which could lead to wide fluctuations in our share price. You may be unable to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

The market for penny stocks has suffered from patterns of fraud and abuse. Such patterns include but are not limited to: (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

| 16 |

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus and those documents incorporated by reference in this prospectus contain forward-looking statements. Statements contained in this prospectus that refer to the Company’s estimated or anticipated future results are forward-looking statements that reflect current perspectives of existing trends and information as of the date of this prospectus. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “plan,” “could,” “should,” “estimate,” “expect,” “forecast,” “outlook,” “guidance,” “intend,” “may,” “might,” “will,” “possible,” “potential,” “predict,” “project,” or other similar words, phrases or expressions. Such forward-looking statements include statements about the Company’s plans, objectives, expectations and intentions. It is important to note that the Company’s goals and expectations are not predictions of actual performance. Actual results may differ materially from the Company’s current expectations depending upon a number of factors affecting the Company’s business. These risks and uncertainties include those set forth under “Risk Factors” beginning on page 2, as well as, among others, business effects, including the effects of industry, economic or political conditions outside of the Company’s control; the inherent uncertainty associated with financial projections; the anticipated size of the markets and continued demand for the Company’s products and services; the impact of competitive services, products and pricing; and access to available financing on a timely basis and on reasonable terms. We caution you that the foregoing list of important factors that may affect future results is not exhaustive.

When relying on forward-looking statements to make decisions with respect to the Company, investors and others should carefully consider the foregoing factors and other uncertainties and potential events and read the Company’s filings with the SEC for a discussion of these and other risks and uncertainties. The Company undertakes no obligation to update or revise any forward-looking statement, except as may be required by law. The Company qualifies all forward-looking statements by these cautionary statements.

We will incur all costs associated with this registration statement and prospectus, which we anticipate to be approximately $23,000. We will not receive any proceeds from the sale of our common stock covered hereby by the Selling Stockholder. The shares of common stock to be sold in this offering have not yet been issued and will only be issued upon conversion of the shares of the Series B-1 Preferred Stock.

MARKET PRICE FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

Our Common Stock is not listed on any stock exchange and is quoted on the OTC Pink Market under the symbol “INQR”. Because our Common Stock is not listed on a securities exchange and its quotation on the OTC Pink is limited and sporadic, there is currently no established public trading market for our Common Stock. The following table sets forth the high and low closing sales prices per share of our Common Stock as reported for the periods indicated. Such quotations represent inter-dealer prices without retail markup, markdown or commissions and may not necessarily represent actual transactions. On July __, 2023, the closing price for our Common Stock as reported on the OTC Pink was $[●] per share.

| Quarter Ended | High | Low | ||||||

| March 31, 2020 | $ | 0.0025 | $ | 0.0013 | ||||

| June 30, 2020 | $ | 0.0022 | $ | 0.0010 | ||||

| September 30, 2020 | $ | 0.0036 | $ | 0.0018 | ||||

| December 31, 2020 | $ | 0.0027 | $ | 0.0012 | ||||

| March 31, 2021 | $ | 0.0064 | $ | 0.0016 | ||||

| June 30, 2021 | $ | 0.0308 | $ | 0.0027 | ||||

| September 30, 2021 | $ | 0.0162 | $ | 0.0088 | ||||

| December 31, 2021 | $ | 0.0126 | $ | 0.0049 | ||||

| March 31, 2022 | $ | 0.0065 | $ | 0.0029 | ||||

| June 30, 2022 | $ | 0.0069 | $ | 0.0027 | ||||