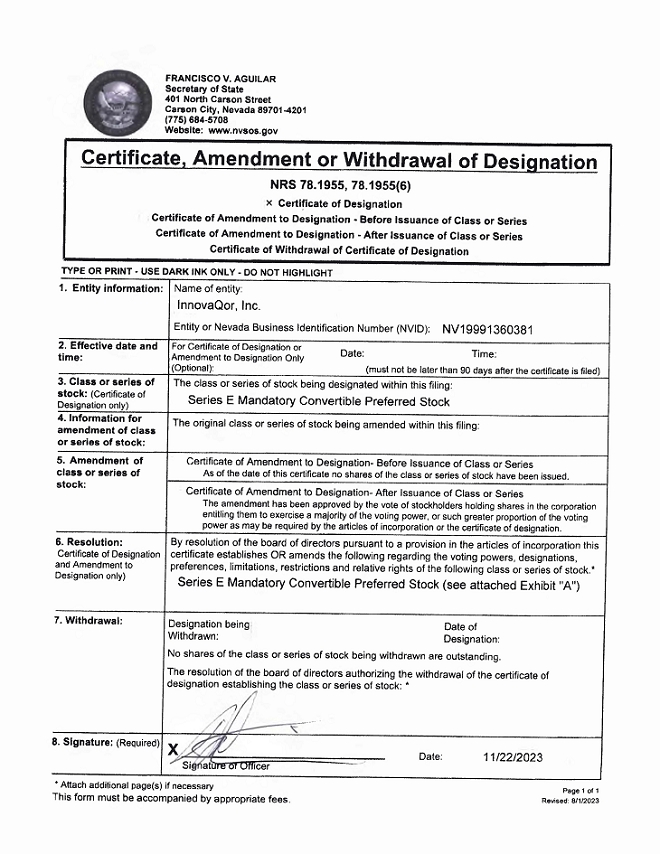

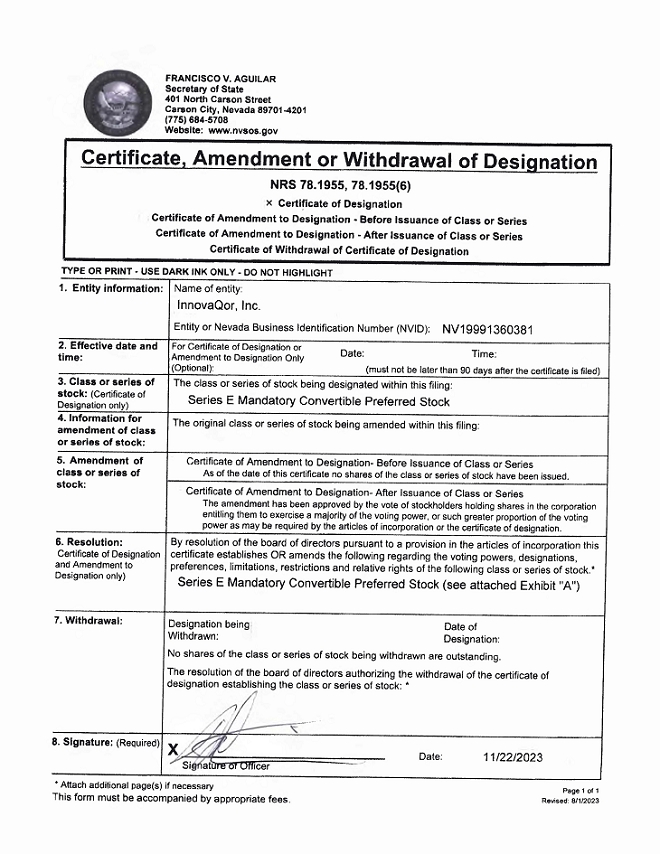

Exhibit 3.1

EXHIBIT “A”

TO

CERTIFICATE OF DESIGNATION

INNOVAQOR, INC.

Section 1. Definitions. For the purposes hereof, the following terms shall have the following meanings:

“Affiliate” means any Person that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under common control with a Person, as such terms are used in and construed under Rule 405 of the Securities Act.

“Alternate Consideration” shall have the meaning set forth in Section 7(c).

“Business Day” means any day except any Saturday, any Sunday, any day which is a federal legal holiday in the United States or any day on which banking institutions in the State of Florida are authorized or required by law or other governmental action to close.

“Commission” means the United States Securities and Exchange Commission.

“Common Stock” means the Corporation’s common stock, par value $0.0001 per share, and stock of any other class of securities into which such securities may hereafter be reclassified or changed.

“Common Stock Equivalents” means any securities of the Corporation or the Subsidiaries which would entitle the holder thereof to acquire at any time Common Stock, including, without limitation, any debt, preferred stock, rights, options, warrants or other instrument that is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

“Conversion Amount” means the sum of the Stated Value at issue.

“Conversion Price” shall have the meaning set forth in Section 6(b).

“Conversion Shares” means, collectively, the shares of Common Stock issuable upon conversion of the shares of Preferred Stock in accordance with the terms hereof.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Fundamental Transaction” shall have the meaning set forth in Section 7(c).

“Holder” means a holder of the Preferred Stock.

“Junior Securities” means the Common Stock and all other Common Stock Equivalents of the Corporation other than those securities (i) which are explicitly senior or pari passu to the Preferred Stock, or (ii) to which the Preferred Stock is explicitly junior in dividend rights or liquidation preference.

| 2 |

“Liquidation” shall have the meaning set forth in Section 5.

“Mandatory Conversion Date” means December 31, 2026.

“Original Issue Date” means the date of the first issuance of any shares of the Preferred Stock regardless of the number of transfers of any particular shares of Preferred Stock and regardless of the number of certificates which may be issued to evidence such Preferred Stock.

“Person” means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company, joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“Preferred Stock” shall have the meaning set forth in Section 2.

“Rule 144” means Rule 144 promulgated by the Commission pursuant to the Securities Act, as such Rule may be amended from time to time, or any similar rule or regulation hereafter adopted by the Commission having substantially the same effect as such Rule.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Share Delivery Date” shall have the meaning set forth in Section 6(c).

“Stated Value” shall have the meaning set forth in Section 2.

“Subsidiary” means any direct or indirect subsidiary of the Corporation presently existing or formed or acquired after the date hereof.

“Successor Entity” shall have the meaning set forth in Section 7(c).

“Trading Day” means a day on which the principal Trading Market is open for business.

“Trading Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question: the NYSE MKT, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the New York Stock Exchange, OTCQB, OTCQX or OTC Pink (or any successors to any of the foregoing).

“Transfer Agent” means Olde Monmouth Stock Transfer Co., the current transfer agent of the Corporation with a mailing address of 200 Memorial Parkway, Atlantic Highlands, New Jersey 07716, and any successor transfer agent of the Corporation.

Section 2. Designation, Amount and Par Value. The series of preferred stock shall be designated as its Series E Mandatory Convertible Preferred Stock (the “Preferred Stock”) and the number of shares so designated shall be up to 5,000. Each share of Preferred Stock shall have a par value of $0.0001 per share and a stated value equal to (i) $100.00, until the day before the first anniversary of the Original Issue Date; (ii) $120.00 from the first anniversary of the Original Issue Date until the day before the second anniversary of the Original Issue Date; and (iii) $140.00 from and after the second anniversary of the Original Issue Date (such amount, as applicable, the “Stated Value”).

| 3 |

Section 3. Dividends. Except for stock dividends or distributions for which adjustments are to be made pursuant to Section 7, Holders shall not be entitled to receive dividends on shares of Preferred Stock.

Section 4. Voting Rights. Each Holder shall be entitled to vote on all matters submitted to a vote of the holders of the Common Stock. With respect to a vote of stockholders, each share of Preferred Stock held by a Holder shall be entitled to the whole number of votes equal to (i) the Stated Value of such share of Preferred Stock, divided by (ii) the average closing price of the Common Stock on the 10 Trading Days immediately prior to the applicable record date for such vote (but in no event less than the par value of the Common Stock). With regard to any vote or written consent, the Preferred Stock shall be entitled to vote or, if applicable, provide consent, together with the holders of Common Stock as if they were a single class of securities. However, as long as any shares of Preferred Stock are outstanding, the Corporation shall not, without the affirmative vote of the Holders of a majority of the then outstanding shares of the Preferred Stock, (a) alter or change adversely the powers, preferences or rights given to the Preferred Stock or alter or amend this Certificate of Designation (other than to increase the number of shares of Preferred Stock), (b) amend its certificate of incorporation or other charter documents in any manner that adversely affects any rights of the Holders, or (c) enter into any agreement with respect to any of the foregoing.

Section 5. Liquidation. Upon any liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary (a “Liquidation”), the Holders shall be entitled to receive out of the assets, whether capital or surplus, of the Corporation an amount equal to the Stated Value, plus any fees or other amounts then due and owing thereon under this Certificate of Designation, for each share of Preferred Stock before any distribution or payment shall be made to the holders of any Junior Securities, and if the assets of the Corporation shall be insufficient to pay in full such amounts, then the entire assets available to be distributed to the Holders shall be ratably distributed among the Holders in accordance with the respective amounts that would be payable on such shares if all amounts payable thereon were paid in full. The Corporation shall mail written notice of any such Liquidation, not less than 45 days prior to the payment date stated therein, to each Holder.

Section 6. Conversion.

(a) Mandatory Conversion. Each share of Preferred Stock shall automatically convert (unless previously redeemed by the Corporation) on the Mandatory Conversion Date into that number of shares of Common Stock determined by dividing the Stated Value of such share of Preferred Stock by the Conversion Price. The Person entitled to receive the shares of Common Stock issuable upon mandatory conversion of the Preferred Stock shall be treated as the record holder of such shares of Common Stock as of the close of business on the Mandatory Conversion Date. No share of Preferred Stock may be converted prior to the Mandatory Conversion Date.

| 4 |

(b) Conversion Price. The conversion price for the Preferred Stock shall equal the average closing price of the Common Stock on the 10 Trading Days immediately prior to the Mandatory Conversion Date, but in no event less than the par value of the Common Stock (the “Conversion Price”).

(c) Mechanics of Conversion.

(i) Delivery of Conversion Shares Upon Conversion. Not later than the earlier of (i) two (2) Trading Days and (ii) the number of Trading Days comprising the Standard Settlement Period (as defined below) after the Mandatory Conversion Date (the “Share Delivery Date”), the Corporation shall deliver, or cause to be delivered, to the converting Holder the number of Conversion Shares being acquired upon the conversion of the Preferred Stock. In compliance with the foregoing sentence, the Corporation shall deliver the Conversion Shares required to be delivered by the Corporation under this Section 6 electronically through the Depository Trust Company or another established clearing corporation performing similar functions. As used herein, “Standard Settlement Period” means the standard settlement period, expressed in a number of Trading Days, on the Corporation’s primary Trading Market with respect to the Common Stock as in effect on the Mandatory Conversion Date.

(ii) Obligations Absolute. The Corporation’s obligations to issue and deliver the Conversion Shares upon conversion of Preferred Stock in accordance with the terms hereof are absolute and unconditional, irrespective of any action or inaction by a Holder to enforce the same, any waiver or consent with respect to any provision hereof, the recovery of any judgment against any Person or any action to enforce the same, or any setoff, counterclaim, recoupment, limitation or termination, or any breach or alleged breach by such Holder or any other Person of any obligation to the Corporation or any violation or alleged violation of law by such Holder or any other person, and irrespective of any other circumstance which might otherwise limit such obligation of the Corporation to such Holder in connection with the issuance of such Conversion Shares; provided, however, that such delivery shall not operate as a waiver by the Corporation of any such action that the Corporation may have against such Holder. The Corporation may not refuse conversion based on any claim that such Holder or anyone associated or affiliated with such Holder has been engaged in any violation of law or agreement or for any other reason, unless an injunction from a court, on notice to Holder, restraining and/or enjoining conversion of all or part of the Preferred Stock of such Holder shall have been sought and obtained, and the Corporation posts a surety bond for the benefit of such Holder in the amount of 150% of the Stated Value of Preferred Stock which is subject to the injunction, which bond shall remain in effect until the completion of arbitration/litigation of the underlying dispute and the proceeds of which shall be payable to such Holder to the extent it obtains judgment. In the absence of such injunction, the Corporation shall issue Conversion Shares and, if applicable, cash, upon a properly noticed conversion. Nothing herein shall limit a Holder’s right to pursue actual damages for the Corporation’s failure to deliver Conversion Shares within the period specified herein and such Holder shall have the right to pursue all remedies available to it hereunder, at law or in equity including, without limitation, a decree of specific performance and/or injunctive relief. The exercise of any such rights shall not prohibit a Holder from seeking to enforce damages pursuant to any other Section hereof or under applicable law.

| 5 |

(iii) Reservation of Shares Issuable Upon Conversion. The Corporation covenants that it will have available out of its authorized and unissued shares of Common Stock upon the Mandatory Conversion Date, free from preemptive rights or any other actual contingent purchase rights of Persons other than the Holder (and the other holders of the Preferred Stock), not less than such aggregate number of shares of the Common Stock as shall be issuable (taking into account the adjustments and restrictions of Section 7) upon the conversion of the then outstanding shares of Preferred Stock. The Corporation covenants that all shares of Common Stock that shall be so issuable shall, upon issue, be duly authorized, validly issued, fully paid and nonassessable.

(iv) Fractional Shares. No fractional shares or scrip representing fractional shares shall be issued upon the conversion of the Preferred Stock. As to any fraction of a share which the Holder would otherwise be entitled to receive upon such conversion, the Corporation shall at its election, either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the Conversion Price or round up to the next whole share.

(v) Transfer Taxes and Expenses. The issuance of Conversion Shares on conversion of this Preferred Stock shall be made without charge to any Holder for any documentary stamp or similar taxes that may be payable in respect of the issue or delivery of such Conversion Shares. All Conversion Shares issuable upon a conversion shall be issued and delivered in the name of the Holder of the applicable share of Preferred Stock on the Mandatory Conversion Date.

Section 7. Certain Adjustments.

(a) Subsequent Rights Offerings. If at any time the Corporation grants, issues or sells any Common Stock Equivalents or rights to purchase stock, warrants, securities or other property pro rata to the record holders of any class of shares of Common Stock (the “Purchase Rights”), then the Holder will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which the Holder could have acquired if the Holder had held the number of shares of Common Stock acquirable upon complete conversion of such Holder’s Preferred Stock immediately before the date on which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the grant, issue or sale of such Purchase Rights calculated, for this purpose, as if such date were the Mandatory Conversion Date.

(b) Pro Rata Distributions. During such time as this Preferred Stock is outstanding, if the Corporation declares or makes any dividend or other distribution of its assets (or rights to acquire its assets) to holders of shares of Common Stock, by way of return of capital or otherwise (including, without limitation, any distribution of cash, stock or other securities, property or options by way of a dividend, spin off, reclassification, corporate rearrangement, scheme of arrangement or other similar transaction) (a “Distribution”), at any time after the issuance of this Preferred Stock, then, in each such case, the Holder shall be entitled to participate in such Distribution to the same extent that the Holder would have participated therein if the Holder had held the number of shares of Common Stock acquirable upon complete conversion of this Preferred Stock immediately before the date of which a record is taken for such Distribution, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the participation in such Distribution calculated, for this purpose, as if such date were the Mandatory Conversion Date.

| 6 |

(c) Fundamental Transaction. If, at any time while this Preferred Stock is outstanding, (i) the Corporation, directly or indirectly, in one or more related transactions effects any merger or consolidation of the Corporation with or into another Person, (ii) the Corporation, directly or indirectly, effects any sale, lease, license, assignment, transfer, conveyance or other disposition of all or substantially all of its assets in one or a series of related transactions, (iii) any, direct or indirect, purchase offer, tender offer or exchange offer (whether by the Corporation or another Person) is completed pursuant to which holders of Common Stock are permitted to sell, tender or exchange their shares for other securities, cash or property and has been accepted by the holders of 50% or more of the outstanding Common Stock, (iv) the Corporation, directly or indirectly, in one or more related transactions effects any reclassification, reorganization or recapitalization of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other securities, cash or property, or (v) the Corporation, directly or indirectly, in one or more related transactions consummates a stock or share purchase agreement or other business combination (including, without limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) with another Person whereby such other Person acquires more than 50% of the outstanding shares of Common Stock (not including any shares of Common Stock held by the other Person or other Persons making or party to, or associated or affiliated with the other Persons making or party to, such stock or share purchase agreement or other business combination) (each a “Fundamental Transaction”), then, upon the conversion of this Preferred Stock on the Mandatory Conversion Date, the Holder shall have the right to receive, for each Conversion Share that would have been issuable upon such conversion immediately prior to the occurrence of such Fundamental Transaction (calculated, for this purpose, as if the date of such occurrence were the Mandatory Conversion Date), the number of shares of Common Stock of the successor or acquiring corporation or of the Corporation, if it is the surviving corporation, and any additional consideration (the “Alternate Consideration”) receivable as a result of such Fundamental Transaction by a holder of such Conversion Share. For purposes of any such conversion, the determination of the Conversion Price shall be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one share of Common Stock in such Fundamental Transaction, and the Corporation shall apportion the Conversion Price among the Alternate Consideration in a reasonable manner reflecting the relative value of any different components of the Alternate Consideration. If holders of Common Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holder shall be given the same choice as to the Alternate Consideration it receives upon any conversion of this Preferred Stock following such Fundamental Transaction. To the extent necessary to effectuate the foregoing provisions, any successor to the Corporation or surviving entity in such Fundamental Transaction shall file a new Certificate of Designation with the same terms and conditions and issue to the Holders new preferred stock consistent with the foregoing provisions and evidencing the Holders’ right to convert such preferred stock into Alternate Consideration. The Corporation shall cause any successor entity in a Fundamental Transaction in which the Corporation is not the survivor (the “Successor Entity”) to assume in writing all of the obligations of the Corporation under this Certificate of Designation in accordance with the provisions of this Section 7(c) pursuant to written agreements in form and substance reasonably satisfactory to the Holders of a majority of the then outstanding shares of the Preferred Stock and approved by such Holders (without unreasonable delay) prior to such Fundamental Transaction and shall, at the option of the Holder of the Preferred Stock, deliver to the Holder in exchange for the Preferred Stock a security of the Successor Entity evidenced by a written instrument substantially similar in form and substance to the Preferred Stock which is convertible at the Mandatory Conversion Date for a corresponding number of shares of capital stock of such Successor Entity (or its parent entity) equivalent to the shares of Common Stock acquirable and receivable upon conversion of this Preferred Stock prior to such Fundamental Transaction (calculated as above), and with a conversion price which applies the conversion price hereunder to such shares of capital stock (but taking into account the relative value of the shares of Common Stock pursuant to such Fundamental Transaction and the value of such shares of capital stock, such number of shares of capital stock and such conversion price being for the purpose of protecting the economic value of this Preferred Stock immediately prior to the consummation of such Fundamental Transaction). Upon the occurrence of any such Fundamental Transaction, the Successor Entity shall succeed to, and be substituted for (so that from and after the date of such Fundamental Transaction, the provisions of this Certificate of Designation referring to the “Corporation” shall refer instead to the Successor Entity), and may exercise every right and power of the Corporation and shall assume all of the obligations of the Corporation under this Certificate of Designation with the same effect as if such Successor Entity had been named as the Corporation herein.

| 7 |

(d) Calculations. All calculations under this Section 7 shall be made to the nearest cent or the nearest 1/100th of a share, as the case may be. For purposes of this Section 7, the number of shares of Common Stock deemed to be issued and outstanding as of a given date shall be the sum of the number of shares of Common Stock (excluding any treasury shares of the Corporation) issued and outstanding.

(e) Notice to the Holders. If (A) the Corporation shall declare a dividend (or any other distribution in whatever form) on the Common Stock, (B) the Corporation shall declare a special nonrecurring cash dividend on or a redemption of the Common Stock, (C) the Corporation shall authorize the granting to all holders of the Common Stock of rights or warrants to subscribe for or purchase any shares of capital stock of any class or of any rights, (D) the approval of any stockholders of the Corporation shall be required in connection with any reclassification of the Common Stock, any consolidation or merger to which the Corporation is a party, any sale or transfer of all or substantially all of the assets of the Corporation, or any compulsory share exchange whereby the Common Stock is converted into other securities, cash or property or (E) the Corporation shall authorize the voluntary or involuntary dissolution, liquidation or winding up of the affairs of the Corporation, then, in each case, the Corporation shall cause to be filed at each office or agency maintained for the purpose of conversion of this Preferred Stock, and shall cause to be delivered by email to each Holder at its last email address as it shall appear upon the stock books of the Corporation, at least 20 calendar days prior to the applicable record or effective date hereinafter specified, a notice stating (x) the date on which a record is to be taken for the purpose of such dividend, distribution, redemption, rights or warrants, or if a record is not to be taken, the date as of which the holders of the Common Stock of record to be entitled to such dividend, distributions, redemption, rights or warrants are to be determined or (y) the date on which such reclassification, consolidation, merger, sale, transfer or share exchange is expected to become effective or close, and the date as of which it is expected that holders of the Common Stock of record shall be entitled to exchange their shares of the Common Stock for securities, cash or other property deliverable upon such reclassification, consolidation, merger, sale, transfer or share exchange, provided that the failure to deliver such notice or any defect therein or in the delivery thereof shall not affect the validity of the corporate action required to be specified in such notice. To the extent that any notice provided hereunder constitutes, or contains, material, non-public information regarding the Corporation or any of the Subsidiaries, the Corporation shall simultaneously file such notice with the Commission pursuant to a Current Report on Form 8-K.

| 8 |

Section 8. Ranking. With respect to a Liquidation, the Preferred Stock shall rank (i) senior to the Common Stock, (ii) senior to any class or series of capital stock of the Corporation hereafter created (unless such class or series of capital stock specifically, by its terms, ranks senior or on parity with the Preferred Stock), (iii) on parity with any class or series of capital stock of the Corporation hereafter created specifically ranking, by its terms, on parity with the Preferred Stock, (iv) junior to the Corporation’s Series A-1 Supermajority Voting Preferred Stock, Series B-1 Convertible Redeemable Preferred Stock, Series C-1 Convertible Redeemable Preferred Stock and Series D Non-Convertible Preferred Stock, and (v) junior to any class or series of capital stock of the Corporation hereafter created specifically ranking, by its terms, senior to the Preferred Stock.

Section 9. Redemption.

(a) Corporation Optional Redemption. At any time the Corporation shall have the right to redeem all, or any part, of the Preferred Stock then outstanding. The Preferred Stock subject to redemption pursuant to this Section 9(a) shall be redeemed by the Corporation in cash in an amount equal to the Stated Value of the shares of Preferred Stock being redeemed. The Corporation may exercise its right to require redemption under this Section 9(a) by delivering a written notice thereof to all the Holders. Each redemption notice shall be irrevocable. The notice shall (x) state the date on which the redemption shall occur, which shall not be less than five Trading Days nor more than 20 Trading Days following the delivery of the notice and (y) state the number of shares of Preferred Stock being redeemed from each Holder.

(b) Mechanics of Redemption. The Corporation shall deliver the applicable redemption prices to each Holder in cash on the applicable redemption date. In the event of redemption of less than all of the Preferred Stock, the Corporation shall deliver to each Holder a new certificate representing the shares of Preferred Stock which have not been redeemed. If the Corporation does not pay the applicable redemption price to a Holder, such Holder, at its option, may deliver notice to the Corporation that the redemption of its shares for which it has not been paid shall be null and void.

Section 10. Miscellaneous.

(a) Notices. Any and all notices or other communications or deliveries to be provided by the Holders hereunder shall be in writing and delivered personally, by e-mail attachment, or sent by a nationally recognized overnight courier service, addressed to the Corporation, at the address of its principal executive offices, Attention: Darrell Peterson, email address dpeterson@innovaqor.com, or such other e-mail address or address as the Corporation may specify for such purposes by notice to the Holders delivered in accordance with this Section 10. Any and all notices or other communications or deliveries to be provided by the Corporation hereunder shall be in writing and delivered personally, by e-mail attachment, or sent by a nationally recognized overnight courier service addressed to each Holder at the e-mail address or address of such Holder appearing on the books of the Corporation. Any notice or other communication or deliveries hereunder shall be deemed given and effective on the earliest of (i) the date of transmission, if such notice or communication is delivered via e-mail attachment at the e-mail address set forth in this Section prior to 5:30 p.m. (Eastern time) on any date, (ii) the next Trading Day after the date of transmission, if such notice or communication is delivered via e-mail attachment at the e-mail address set forth in this Section on a day that is not a Trading Day or later than 5:30 p.m. (Eastern time) on any Trading Day, (iii) the second Trading Day following the date of mailing, if sent by U.S. nationally recognized overnight courier service, or (iv) upon actual receipt by the party to whom such notice is required to be given.

| 9 |

(b) Lost or Mutilated Preferred Stock Certificate. If a Holder’s Preferred Stock certificate shall be mutilated, lost, stolen or destroyed, the Corporation shall execute and deliver, in exchange and substitution for and upon cancellation of a mutilated certificate, or in lieu of or in substitution for a lost, stolen or destroyed certificate, a new certificate for the shares of Preferred Stock so mutilated, lost, stolen or destroyed, but only upon receipt of evidence of such loss, theft or destruction of such certificate, and of the ownership hereof and indemnity reasonably satisfactory to the Corporation.

(c) Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Certificate of Designation shall be governed by and construed and enforced in accordance with the internal laws of the State of Nevada, without regard to the principles of conflict of laws thereof. All legal proceedings concerning the interpretation, enforcement and defense of the transactions contemplated by this Certificate of Designation or the Preferred Stock (whether brought against a party hereto or its respective Affiliates, directors, officers, shareholders, employees or agents) shall be commenced in the state and federal courts sitting in the County of Palm Beach, Florida. The Corporation and each Holder hereby irrevocably submits to the exclusive jurisdiction of such courts for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated hereby or discussed herein, and hereby irrevocably waives, and agrees not to assert in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of such courts, or such courts are improper or inconvenient venue for such proceeding. The Corporation and each Holder hereby irrevocably waives personal service of process and consents to process being served in any such suit, action or proceeding by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address in effect for notices to it under this Certificate of Designation and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any other manner permitted by applicable law. The Corporation and each Holder hereby irrevocably waives, to the fullest extent permitted by applicable law, any and all right to trial by jury in any legal proceeding arising out of or relating to this Certificate of Designation or the transactions contemplated hereby. If the Corporation or any Holder shall commence an action or proceeding to enforce any provisions of this Certificate of Designation, then the prevailing party in such action or proceeding shall be reimbursed by the other party for its attorneys’ fees and other costs and expenses incurred in the investigation, preparation and prosecution of such action or proceeding.

| 10 |

(d) Waiver. Any waiver by the Corporation or a Holder of a breach of any provision of this Certificate of Designation shall not operate as or be construed to be a waiver of any other breach of such provision or of any breach of any other provision of this Certificate of Designation or a waiver by any other Holders. The failure of the Corporation or a Holder to insist upon strict adherence to any term of this Certificate of Designation on one or more occasions shall not be considered a waiver or deprive that party (or any other Holder) of the right thereafter to insist upon strict adherence to that term or any other term of this Certificate of Designation on any other occasion. Any waiver by the Corporation or a Holder must be in writing.

(e) Severability. If any provision of this Certificate of Designation is invalid, illegal or unenforceable, the balance of this Certificate of Designation shall remain in effect, and if any provision is inapplicable to any Person or circumstance, it shall nevertheless remain applicable to all other Persons and circumstances. If it shall be found that any interest or other amount deemed interest due hereunder violates the applicable law governing usury, the applicable rate of interest due hereunder shall automatically be lowered to equal the maximum rate of interest permitted under applicable law.

(f) Next Business Day. Whenever any payment or other obligation hereunder shall be due on a day other than a Business Day, such payment or other obligation shall be made on the next succeeding Business Day.

(g) Headings. The headings contained herein are for convenience only, do not constitute a part of this Certificate of Designation and shall not be deemed to limit or affect any of the provisions hereof.

(h) Status of Converted or Redeemed Preferred Stock. If any shares of Preferred Stock shall be converted, redeemed or reacquired by the Corporation, such shares shall resume the status of authorized but unissued shares of preferred stock and shall no longer be designated as Series E Mandatory Convertible Preferred Stock.

| 11 |